Semiconductor Analytics

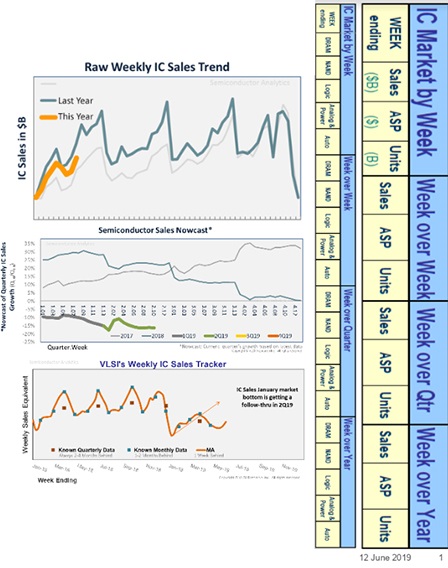

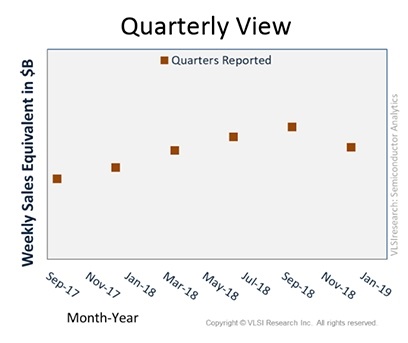

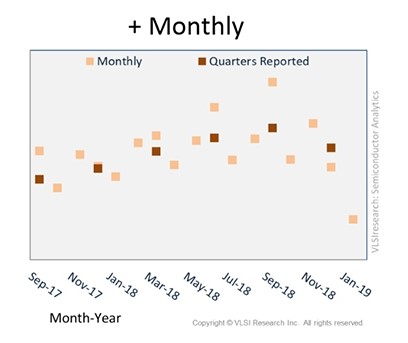

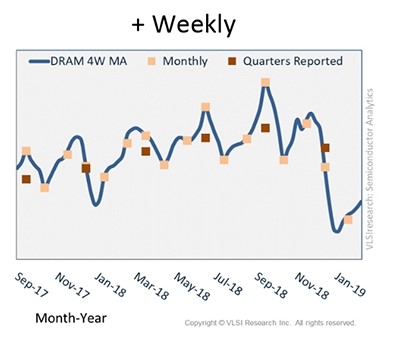

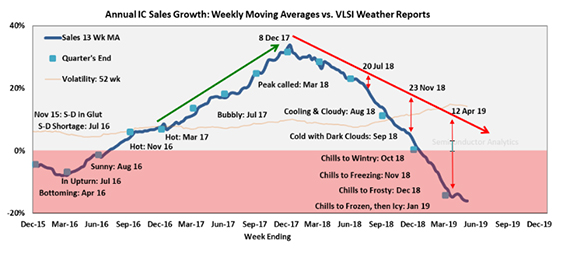

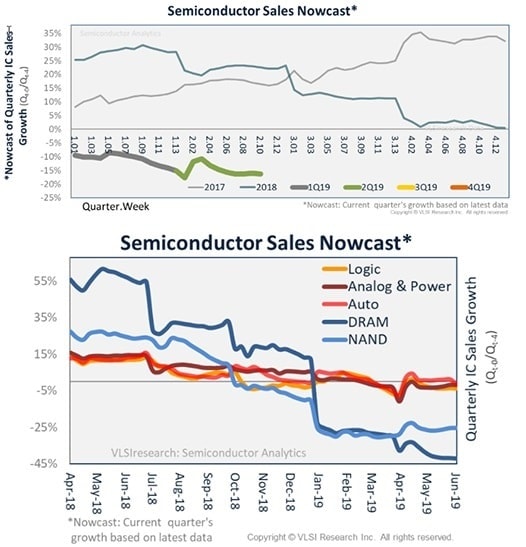

Semiconductor Analytics is a weekly data visualization stream that was developed to address the organizational need to stay abreast of the silicon cycle. With its graphics, you can see when it's turning, not months or quarters later. Semiconductor Analytics is the only source of semiconductor market data available that allows you to zoom into a granularity level of sales-per-week. Instead of stale forecasts based on data that's a month or two old, Semiconductor Analytics brings the power of nowcasting to your fingertips with its comparison of like-periods in the current quarter to the same partial period in the prior year's quarter. You don't have to rely on a single week's data to make decisions, because weekly Nowcast charting lays out a visual trend line of how the quarter's unfolding good or bad.

About Semiconductor Analytics

A data analytics platform that gives weekly sales for the semiconductor market

- Weekly data provides the most real-time data for a faster, more robust decision-making process

Single Stop for Industry Vital Signs

- Know when it's turning as it turns

- Minimize organizational confirmation bias

Low-latency weekly statistics

- 3 business days versus a month or quarter

- Sales, pricing, and activity levels

- Channel technical analysis to visualize trends

All-in-one PDF delivered via email

- Designed for fast reading in an era of data overload

Weekly IC sales tracking gives you the advantage

What's in Semiconductor Analytics

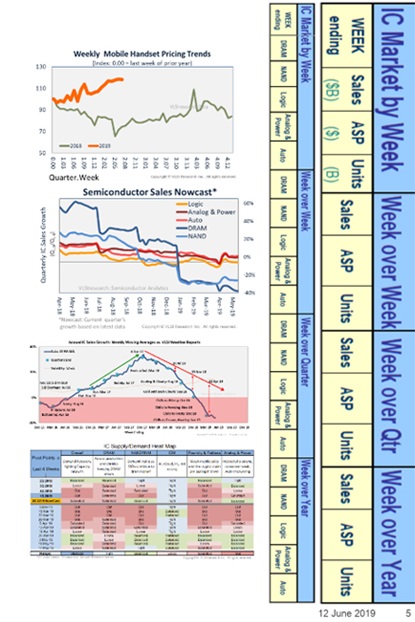

Weekly Semiconductor Sales:

- Total, DRAM, NAND, Logic, Auto, Analog, & Power

- Weekly Growth Metrics: W/W, W/Q, W/Y, Quarter-to-Date Cumulative

- Charts include Nowcasts, indexed data, rolling averages, weekly Y/Y growth

Key Performance Indicators (KPIs) included

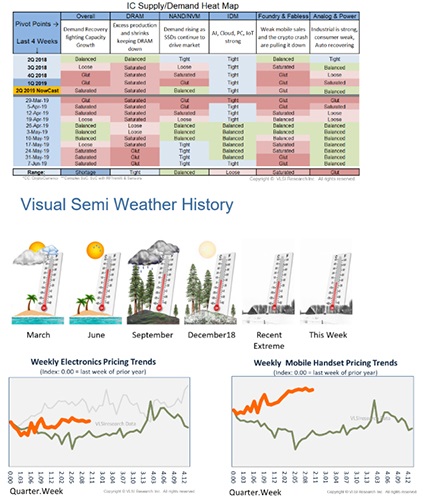

Weekly IC Supply/Demand Heat Map to identify market conditions from Gluts to Shortages

- Supply-Demand Balance for DRAM, NAND, IDM, Foundry/Fabless, Analog, & Power

Weather Report for Memory, Foundry, IDM, SoC, Mobile, IoT, Auto, Analog, & Power

Price trends and averages for critical Electronics Market Segments

- Overall, Notebooks, Mobile Handsets, Tablets, Consumer Electronics

- Multiple sub-segments covered

Use Semiconductor Analytics for

Single Stop for Industry Vital Signs

- Know when it's turning as it turns

- Minimize organizational confirmation bias

- Low-latency weekly statistics

- 3 business days versus a month or quarter

- Sales, pricing, and activity levels

- Channel technical analysis to visualize trends

- Fundamentals readily available

All-in-one PDF delivered via email

- Designed for fast reading in an era of data overload

Available Semiconductor Market Analysis

Chip Market Research

Chip Market Research Services is a modular strategic planning, marketing, and communication tool that spans the semiconductor manufacturing industry.

- The Chip Insider® provides strategic and tactical insights.

- The Forecast Pro provides the real-time data a professional analyst needs to predict how trends in the semiconductor business environment will affect their business and investments.

- IC Equipment Databases cover market shares with annual and quarterly forecasts for these segments.

Semiconductor Analytics

Semiconductor Analytics is a weekly report addressing the semiconductor supply chain. The research and analysis is end-demand focused and has the objective of providing up-to-date business knowledge. Week-by-week data on electronics and semiconductor demand, along with monthly key performance indicators in electronics and semiconductor application markets are provided to semiconductor suppliers.

Critical Subsystems

Critical Subsystems covers the market on subsystems for semiconductor and related production equipment. These subsystems have been developed to address specific applications and processes within these industries and are dedicated for use on a single tool or process chamber. They perform a particular function in the following key technology areas: Fluid Management, Integrated Process Diagnostics, Optical, Process Power, Thermal Management, Vacuum, and Wafer Handling.

Test Connectivity Systems

Annual analytics reports that cover test connectivity markets, suppliers, and key customer trends. They include Probe Card, Test & Burn-in Socket, and Device Interface Board (DIB) market analyses.

Spreadsheets and Reports

Single data spread sheets and reports are derived from subscription services and can be purchased separately. They are ideal for one-time, low cost access to the data. Data sheets and reports are available through the TechInsights Platform.

Research Methodology

The methodology used in compiling information relies heavily on market simulation and consists of several approaches. The basic theme common to all is data triangulation. Wherever possible, we try to box-in an issue from at least three different directions, sometimes more.

Supreme Court Strikes Down IEEPA Tariffs | Semiconductor Impact

The Supreme Court invalidates IEEPA tariffs as the U.S.-Taiwan trade deal reshapes semiconductor import policy. Read the TechInsights report.

Chip Observer: CES 2026, AI Power Plays, and a $48B M&A Surge

CES 2026 semiconductor news: AI PCs, Snapdragon X2 Elite, $48B in M&A, ZAM memory, and a 2026 forecast projecting a $1 trillion chip market.

Intel Panther Lake on Intel 18A: Strategic & Geopolitical Analysis

Explore Intel Panther Lake on Intel 18A, examining advanced-node execution, IDM 2.0 credibility, and strategic implications for the global semiconductor ecosystem.