The Thriving Chiplet Ecosystem: A Look at Growth and Challenges

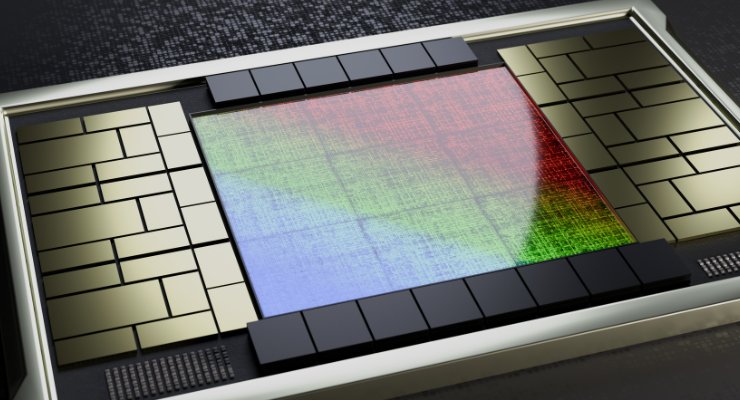

Chiplet technology is rapidly transforming the semiconductor industry, ushering in a new era of modular design. However, a robust ecosystem is essential to unlock its full potential. Let's explore the key players, market growth forecasts, and some of the challenges that lie ahead.

Building the Ecosystem: Key Players and Considerations

The chiplet ecosystem is brimming with activity, with various players contributing to its development:

- Electronic Design Automation (EDA) Companies: The "big three" EDA players Synopsis, Siemens EDA, and Cadence, are actively supporting chiplet design. However, design complexity remains a challenge. Integrating chiplets with their interconnects significantly increases the design workload, demanding advancements in design verification tools.

- Foundries: TSMC and Intel are major foundry players offering proprietary packaging and interconnect technologies specifically designed for chiplets.

- Outsourced Semiconductor Assembly and Test (OSAT) Companies: Major OSAT players like Amkor, ASE, and JCET play a crucial role in chiplet manufacturing. Additionally, companies like IBM with extensive chiplet research experience further contribute to the ecosystem's growth.

Innovation at the Forefront: Pioneering Designs and Initiatives

- AMD: A leader in chiplet technology, AMD has been at the forefront with the introduction of their EPYC processor with four chiplets in 2017. They continue to integrate chiplet designs across various product lines.

- DARPA's CHIPS Program: The US Department of Defense's (DoD) research agency, DARPA, has been actively promoting chiplet adoption through its CHIPS program. This initiative aims to establish heterogeneous packaging facilities within the US, partnering with companies like Intel, Xilinx, and Keysight.

Testing Considerations in a Chiplet World

Chiplet production presents unique challenges for testing companies. The higher volume of individual die necessitates increased testing workloads. Additionally, ensuring proper functionality before final packaging becomes crucial, especially in stacked chiplet designs.

Market Growth Projections: A Thriving Future

The chiplet market is poised for significant growth, with a projected increase from 15% to 33% of the total chip market by 2030. This translates to an impressive CAGR of 19.7% for chiplets compared to a modest 3.8% for monolithic devices.

Key Drivers of Chiplet Adoption

- High-Performance Computing: Servers, high-performance computing (HPC), and data centers are major beneficiaries of chiplet technology, fueled by the growth of Artificial Intelligence (AI).

- Gaming Performance: Chiplets are enabling significant performance improvements in consumer PC gaming. AMD's Ryzen 7 5800X3D desktop CPU with 3D-stacked L3 cache showcases a 15% boost in gaming performance.

- Edge Computing: Specific use cases in edge computing, such as Advanced Driver-Assistance Systems (ADAS), leverage the flexibility offered by chiplet-based designs.

Conclusion

The chiplet ecosystem is brimming with potential, fostering innovation and propelling semiconductor technology forward. By addressing current challenges and leveraging the strengths of key players, the chiplet market is poised to experience explosive growth in the coming years.

The Future of Chiplet Technology

The future of chip design is inextricably linked to chiplets. As the technology matures, the chiplet ecosystem will continue to develop, offering a wider range of pre-designed, high-quality chiplets.

For the full story on chiplets, the history, applications, and forecasts, read Chiplet Market Introduction: Computing.

TechInsights’ 2026 Outlook Summit Series

TechInsights’ 2026 Outlook Summit brings together leading semiconductor experts to decode the year ahead.

Supreme Court Strikes Down IEEPA Tariffs | Semiconductor Impact

The Supreme Court invalidates IEEPA tariffs as the U.S.-Taiwan trade deal reshapes semiconductor import policy. Read the TechInsights report.

Chip Observer: CES 2026, AI Power Plays, and a $48B M&A Surge

CES 2026 semiconductor news: AI PCs, Snapdragon X2 Elite, $48B in M&A, ZAM memory, and a 2026 forecast projecting a $1 trillion chip market.

Intel Panther Lake on Intel 18A: Strategic & Geopolitical Analysis

Explore Intel Panther Lake on Intel 18A, examining advanced-node execution, IDM 2.0 credibility, and strategic implications for the global semiconductor ecosystem.