![]()

Component Pricing Landscape and Analysis

Insightful Component Pricing Analytics of Current Market Pricing and Future Trends.

Data science intelligence applied to real crowd-sourced pricing.

TechInsights brings together unique industry insight gained from over 20 years of experience in performing teardowns in some of the highest volume applications combined with crowd-sourced pricing data from companies.

1000s

products analyzed

Millions

components priced

20+

years experience

100s

repeat customers

The Component Pricing Advantage

At TechInsights we believe that it is not enough to just understand point-in-time market prices and lead times but also where they are headed.

Component Price Landscape (CPL)

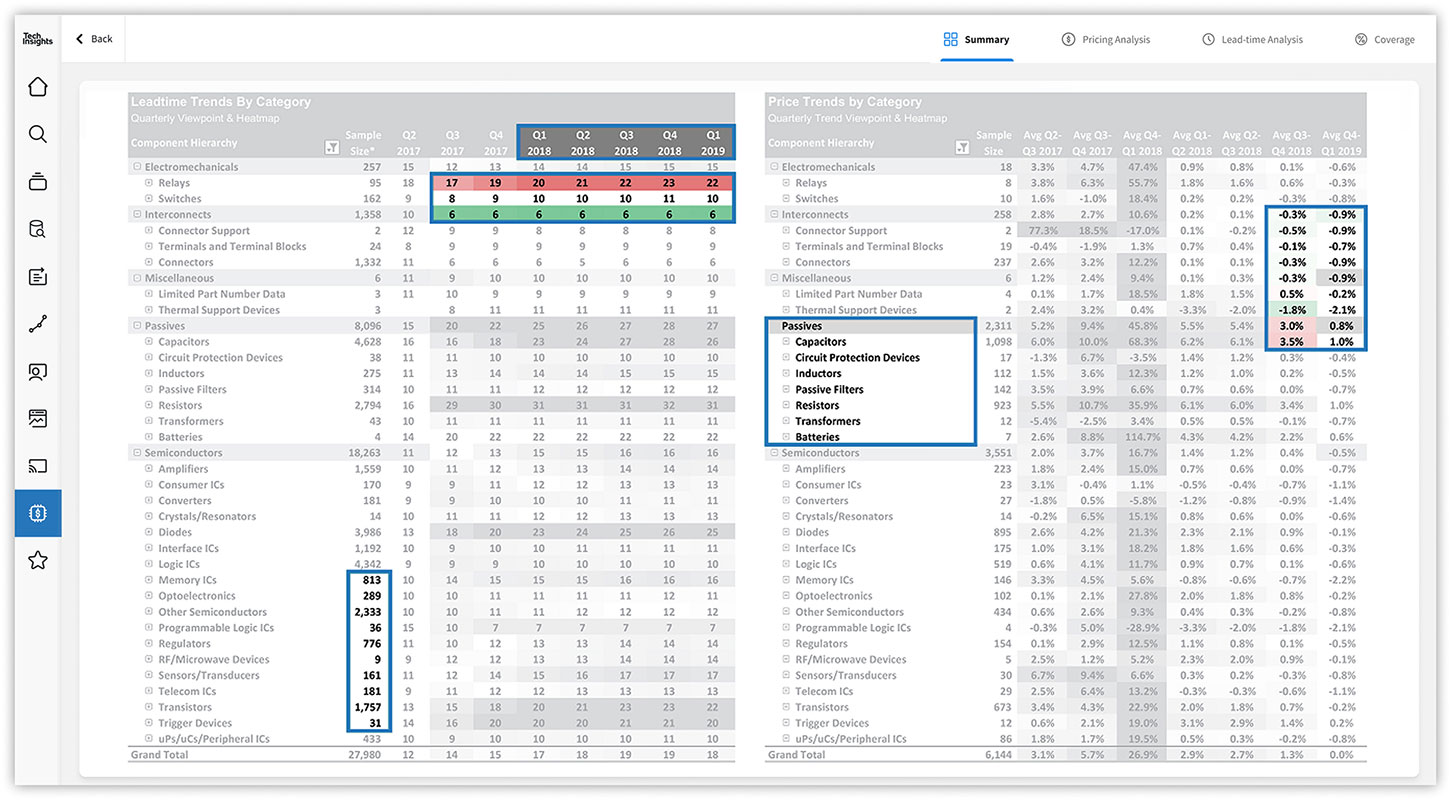

Component Price Landscape (CPL) tracks pricing and lead-time trends for commodity electronic components that are used in many electronic designs.

CPL is the industry’s premier tool for tracking pricing and lead-time trends for commodity electronic components:

- Tracking price trends to understand where prices are increasing or decreasing

- Leverage industry insight to lock in favorable pricing now or maybe delay purchases to a later date

- Tracking lead-time trends for 700+ commodity EE* component suppliers

- Gain early insight into pending supply shortages or allocation issues

- Understand potential second sources to ensure supply continuity

Component Price Analyzer (CPA)

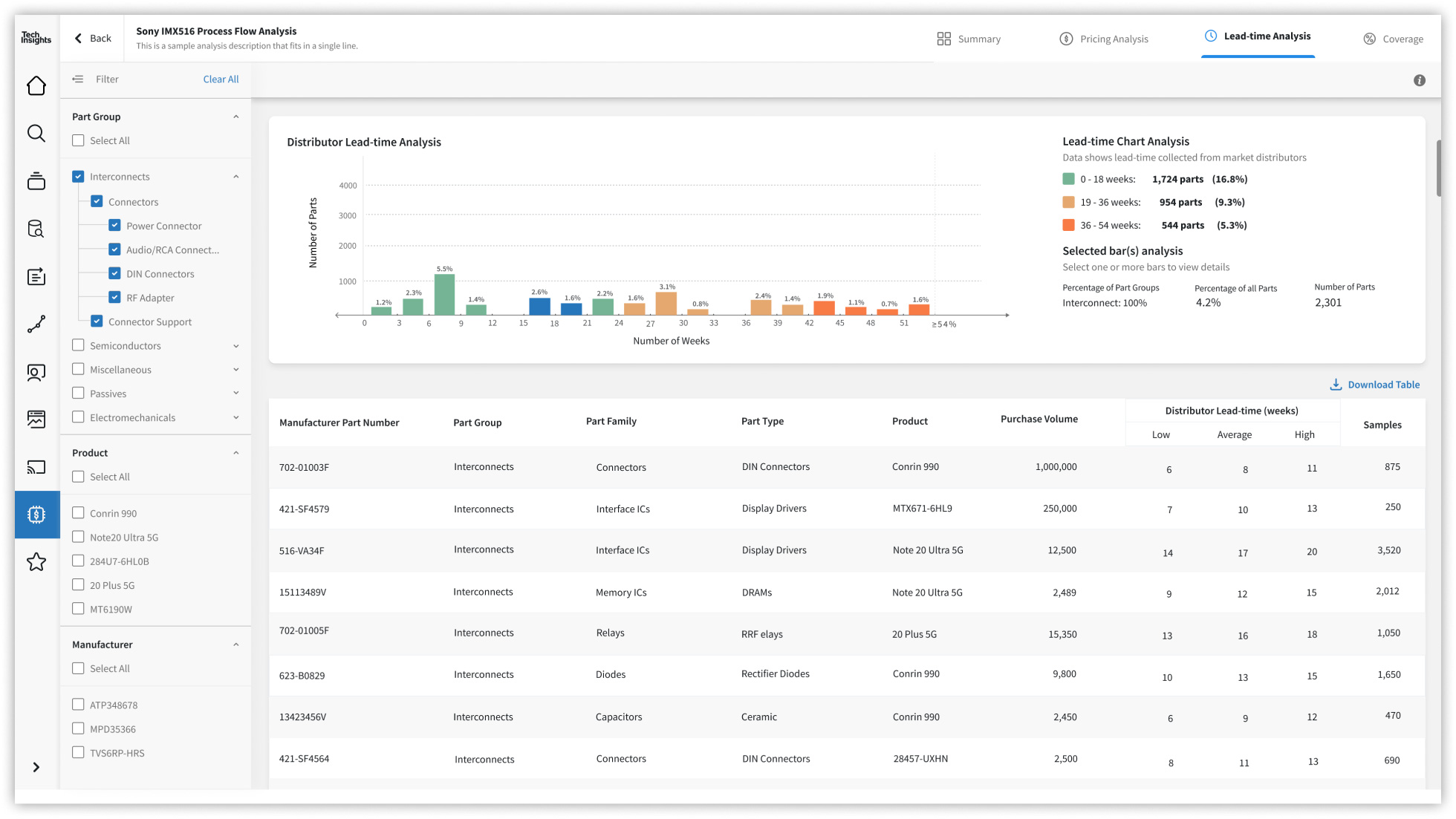

CPA is a new tool to help clients to quickly understand the cost impact of proposed designs during the development stages.

Data science algorithms are used to make sense of this data to establish up-to-date market pricing curves for each manufacturer part number (MPN).

- Analyses customer specific electrical eng. (EE) BOMs

- Compares component prices with market prices for your specific purchase volumes

- Real contract OEM pricing combined with data-science algorithmic estimations

- Determine the most realistic price for your purchase volume

- Identify focus to gain maximum cost reduction

Component Pricing Supports Multiple Teams and KPIs:

During the development stages of a product, product teams need to “quickly” understand

- The realistic cost of components that engineers select for a product

- The cost needs to be appropriate for the intended purchase volume quantity

- OEMs also need to have early visibility on MPN availability issues

TechInsights helps them to determine market pricing for your BOM at projected target volume, twice the projected target volume and half the projected target volume.

These teams often work with multiple product Business Units (BUs) in order to understand the component requirements for each product within the BU in order to develop an aggregated understand of demand for the company. TechInsights helps them to:

- Determine market pricing for aggregated purchases

- Identify where to best focus limited procurement resources to hit corporate cost reduction targets

- Continually drive cost reductions during production, based on latest market pricing data

Supply-chain teams need early visibility on potential supply commodity issues that could impact lead-times.

TechInsights povides early visibility on lead-time trends for commodity electronic components at a category-level e.g. ceramic capacitors.