Temperatures are cooling amid rising uncertainty

Andrea Lati

- Order activity for semiconductor equipment slipped to 82 degrees

- The weakness in Memory and Subcon/Adv. Packaging continued to weigh on the overall activity

- The memory market is now in the midst of a downturn due to a significant supply/demand imbalance

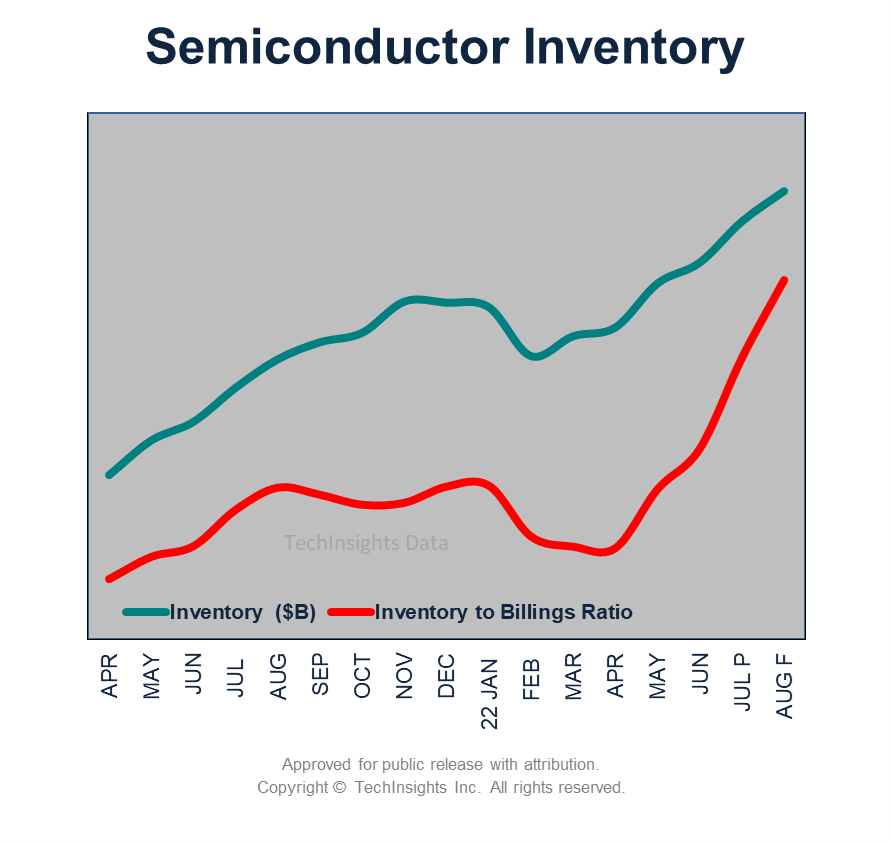

- This imbalance has been brewing for several months and it is something that we’ve been warning about

- The CPPI has been flashing warning signals since March

- Memory inventories will continue to rise next quarter due to wafers in process, but after that memory producers will start hitting the brakes and cut spending in order to align supply with end demand

- This downshift in market conditions is not expected to have a significant impact on equipment revenues in the next two quarters due to the deferred revenues, which are likely to offset the declaration in shipments

- TechInsights’ Chip Price Performance Index extended its slump

- DRAM declined

- NAND declined

- MPUs declined

- Inventories continue to build up

Free Newsletter

Get the latest analysis of new developments in semiconductor market and research analysis.

Subscribers can view the full article in the TechInsights Platform.

You must be a subscriber to access the Manufacturing Analysis reports & services.

If you are not a subscriber, you should be! Enter your email below to contact us about access.