TechInsights' Semiconductor Analytics Report

G. Dan Hutcheson

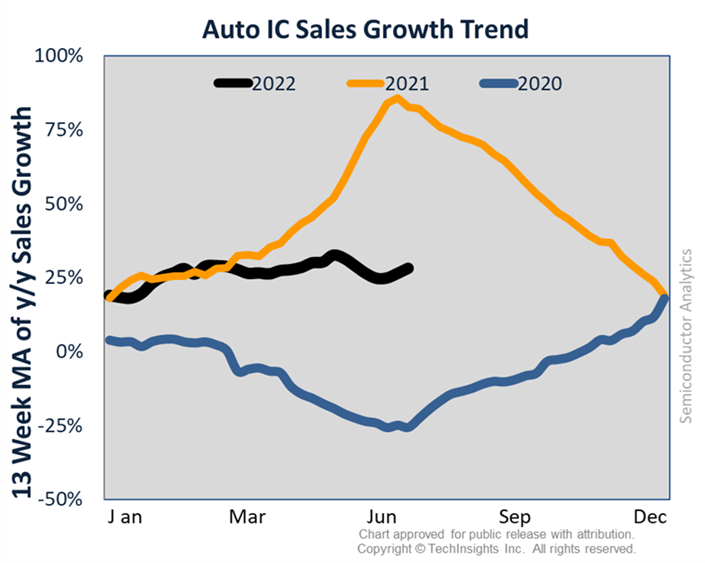

Semiconductor sales growth continued its sideways path, but is 17% above 2021 levels. The IC weather cooled 0˚F last week. Zooming in on Auto ICs this week, the 13-wk MA returned to the high 20% range after dipping in June. TechInsights forecasts A&P will reach $35B in 2022, with Y/Y growth of 23%.

TechInsights’ IC Supply/Demand indices held last week at Saturated, as conditions were mixed between a buyer’s & seller’s market. More than Moore dropped into a Glut while OSAT returned to Loose. New lockdowns in China are problematic in ascertaining the true status for OSATs. Chip demand is being cooled by inflation and monetary tightening. Capacity expansion and Just-in-Case are driving up supply and inventory.

Electronics’ Retail Prices are declining.

Free Newsletter

Get the latest analysis of new developments in semiconductor market and research analysis.

Subscribers can view more articles in the TechInsights Platform.

You must be a subscriber to access the Manufacturing Analysis reports & services.

If you are not a subscriber, you should be! Enter your email below to contact us about access.