TechInsights' Semiconductor Analytics Report

G. Dan Hutcheson

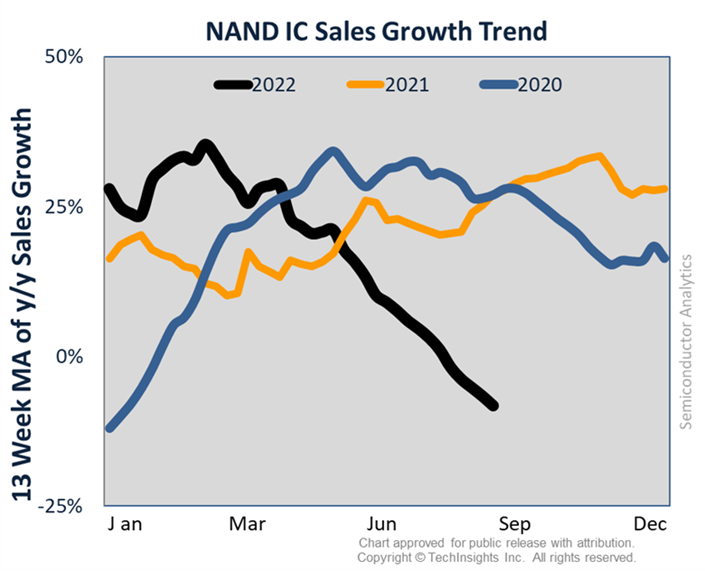

Semiconductor sales continued to draw down below 2021 levels last week, as the IC weather warmed 1˚F in Chilly conditions. Zooming in on NAND this week, the 13-wk growth MA dropped to -8% Y/Y, falling off last year’s peak of +33% in November. TechInsights forecasts it will slide to $61B in 2022, with Y/Y growth of 0% that falls to -8% in 2023, which may be optimistic.

TechInsights’ IC Supply/Demand metrics weakening trend reversed course last week with NAND moving out of Glut conditions to Saturated. The unchanged segments were DRAM, Foundry, OSAT, IDM, Analog and Power, and Auto ICs. Even though overall conditions are saturated, spot shortages remain for some SKUs in microcontrollers and op-amp categories.

Electronics’ Retail Prices trend is down.

Free Newsletter

Get the latest analysis of new developments in semiconductor market and research analysis.

Subscribers can view more articles in the TechInsights Platform.

You must be a subscriber to access the Manufacturing Analysis reports & services.

If you are not a subscriber, you should be! Enter your email below to contact us about access.