TechInsights Critical Subsystems Driving Forces Update on Platform

Updates included are the following:

- Driving Forces

- Device Forecast Summary

- History and Forecast for Electronics Revenues (not updated this month)

- History and Forecast for Semiconductor Revenues Unit Shipments, and ASPs (not updated this month)

- History and Forecast for FPD Revenues

- History and Forecast for PV Revenues, Unit Shipments, and ASPs

- Manufacturing Equipment Forecasts

- History and Forecast for Semiconductor, FPD, PV Manufacturing Equipment Revenues

- Both Annual and Quarterly data

- Substrate processing equipment shipments

- History and Forecast for Semiconductor, FPD, PV Manufacturing Equipment unit shipments

- Both Annual and Quarterly data

- Also shows Annual ASP for Semi, FPD, PV Manufacturing Equipment

- Substrate process equipment installed base

- History and Forecast for Semiconductor, FPD, PV Manufacturing Equipment installed base

- Annual

- Chamber Shipments

- History and Forecast for Semiconductor, FPD, PV process chambers and module shipments

- Both Annual and Quarterly data

- CSUBs Forecasts

- History and Forecast for Critical Subsystems

- Both Annual and Quarterly data

- Device Forecast Summary

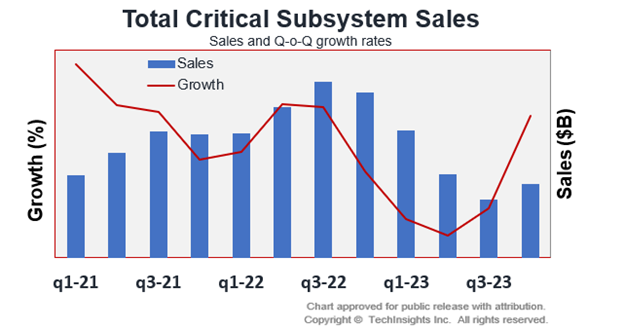

Combined Critical Subsystems are expected to grow 12% in 2022 (Y-o-Y), surpassing $20B. Semiconductor critical subsystem revenue will surge 15% this year, propelled by a strong WFE market. Headwinds are in full force for the upcoming 2022 Q4 due to rising interest rates in the US, Chinese export controls and a dim macroeconomic outlook. As a result, the semiconductor market is slowing down significantly in 2023 and is expected to slip into the negative as early as Q4 2022. Therefore, we expect semiconductor critical subsystem sales to decline 19% in 2023 as chipmakers rein in spending to assess the slowing demand.

Critical Subsystems for FPD had a slight recovery in Q3 2022 but is still expected to fall 15% in 2022 (Y-o-Y) and slump another 4% in 2023. The PV subsystem market will continue to grow in 2022 and is expected to close the year above 20% followed by a fall of 2% in 2023.

2024 is forecast to be a recovery year with double digit growth in the Semiconductor subsystem industry. FPD and PV subsystems are both expected to recover at single digit growth.

Looking at quarterly growth rates, subsystems continued to grow in the third quarter of 2022 reaching a record high of $6B. However, negative growth is forecast for the fourth quarter of 2022 and the first three quarters of 2023 followed by a recovery in the fourth quarter of 2023 and into 2024.

Free Newsletter

Get the latest analysis of new developments in semiconductor market and research analysis.

Subscribers can view the full article in the TechInsights Platform.

You must be a subscriber to access the Manufacturing Analysis reports & services.

If you are not a subscriber, you should be! Enter your email below to contact us about access.