TechInsights' Critical Sub-System Driving Forces

Updates included are the following:

- Driving Forces

- Device Forecast Summary

- History and Forecast for Electronics Revenues

- History and Forecast for Semiconductor Revenues, Unit Shipments, and ASPs

- History and Forecast for FPD Revenues

- History and Forecast for PV Revenues, Unit Shipments, and ASPs

- Manufacturing Equipment Forecasts

- History and Forecast for Semiconductor, FPD, PV Manufacturing Equipment Revenues

- Both Annual and Quarterly data

- Substrate processing equipment shipments

- History and Forecast for Semiconductor, FPD, PV Manufacturing Equipment unit shipments

- Both Annual and Quarterly data

- Also shows Annual ASP for Semi, FPD, PV Manufacturing Equipment

- Substrate processing equipment installed base

- History and Forecast for Semiconductor, FPD, PV Manufacturing Equipment installed base

- Annual data

- Chamber Shipments

- History and Forecast for Semiconductor, FPD, PV process chambers and module shipments

- Both Annual and Quarterly data

- CSUBs Forecasts

- History and Forecast for Critical Subsystems

- Both Annual and Quarterly data

- Device Forecast Summary

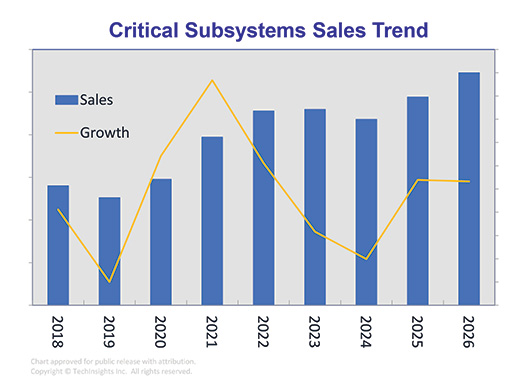

Robust semiconductor demand continues to drive Critical Subsystem sales to record high levels. Critical Subsystems for FPD and PV markets will continue to recover over the next few years. Combined Critical Subsystems are expected to grow 16% in 2022, surpassing $20B.

You must be a subscriber to access the Manufacturing Analysis reports & services.

If you are not a subscriber, you should be! Enter your email below to contact us about access.