TechInsights' 2022 Semiconductor Forecast Raised to 14%

G. Dan Hutcheson

Semiconductor Analytics

Semiconductor sales pulled back for a second week in a typical February drawdown, albeit at unseen historical heights. The IC weather warmed 1°F last week.

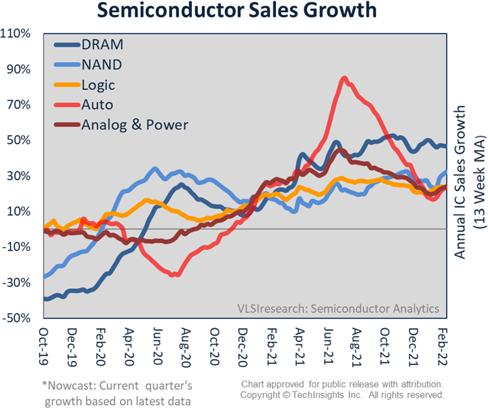

Semiconductor Sales growth continued to hover above the 20% Y/Y bar last week. Growth at this level, this early in the year, hasn't been seen for four years. Also, 4Q21 is coming in much stronger than expected, as the shortage drives ASPs up.

Zooming in on overall growth this week, TechInsights' 2022 Forecast was upped from 10% to 14% based on higher 4Q21 results. ICs were at 30% vs. 26%. All segments are now expected to grow at double-digit rates for a second year, with Auto ICs the fastest and Analog & Power just behind.

TechInsights' IC Supply/Demand indices were mixed last week. More Moore Foundry tightened and More than Moore rose, meanwhile Auto ICs eased. Unchanged were DRAM, NAND, IDM, OSAT, and Analog & Power. Overall conditions remain Tight, where they have been since 24 Sep 21.

Electronics' Retail Prices continue to soar.

Free Newsletter

Get the latest analysis of new developments in semiconductor market and research analysis.

Subscribers can view the full article in the TechInsights Platform.

You must be a subscriber to access the Manufacturing Analysis reports & services.

If you are not a subscriber, you should be! Enter your email below to contact us about access.