Still Hot and Green but Distant Macro Clouds Loom

Andrea Lati

The Chip Insider®

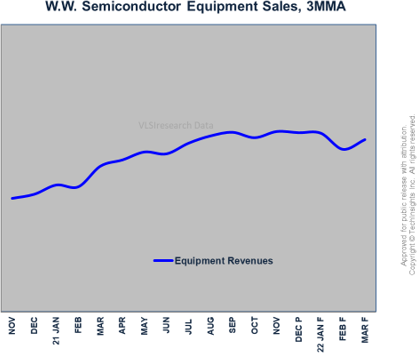

- Order activity for semiconductor equipment continued to trend lower, slipping half a point in the last week of March

- The slight pullback in the last five weeks has been driven primarily by the memory segment

- Despite the slight pullback, the overall level of activity remains near record levels

- This should translate into another strong year for equipment suppliers in 2022

- Supply chain constraints remain an ongoing issue for equipment suppliers

- Growth for the equipment market will be weighted more towards the second half of the year

- The macro outlook is becoming cloudier

- Increasing interest rates along with soaring energy prices will put negative pressure on economic growth in the second half of the year

- As semiconductors re-couple with the macroeconomy, the macro headwinds are likely to slow the momentum in the semiconductor market for 2023

- TechInsights' Chip Price Performance Index declined again

- DRAM fell

- NAND rose

- MPUs rose

- Shortages and supply chain constraints had an impact on the equipment market in 4Q21

Free Newsletter

Get the latest analysis of new developments in semiconductor market and research analysis.

Subscribers can view the full article in the TechInsights Platform.

You must be a subscriber to access the Manufacturing Analysis reports & services.

If you are not a subscriber, you should be! Enter your email below to contact us about access.