It's still very warm but there are bears around

Andrea Lati

- Order activity for semiconductor equipment continued to trend lower, slipping to 83 degrees

- Activity in SOC Mobile, SOC Compute, and DAO is holding up well as equipment suppliers catch up with customers’ CapEx plans

- The strength of spending at the Foundries/Adv. Logic and DAO will more than offset the weakness in Memory and keep the overall equipment market growing in 2022

- The equipment forecast for 2022 was lowered from 13% to 10% as supply constraints continued to limit growth

- The IC forecast for 2022 was also lowered from 13% to 7% due to a bigger-than-expected correction in the Memory market in 2H22

- Because the market correction is happening faster, and at a great clip, we now expect both equipment and ICs to decline by 5% and 4%, respectively in 2023

- TechInsights’ Chip Price Performance Index remains in a free-fall state, signaling more weakness ahead

- DRAM tumbled

- NAND crashed

- MPUs declined

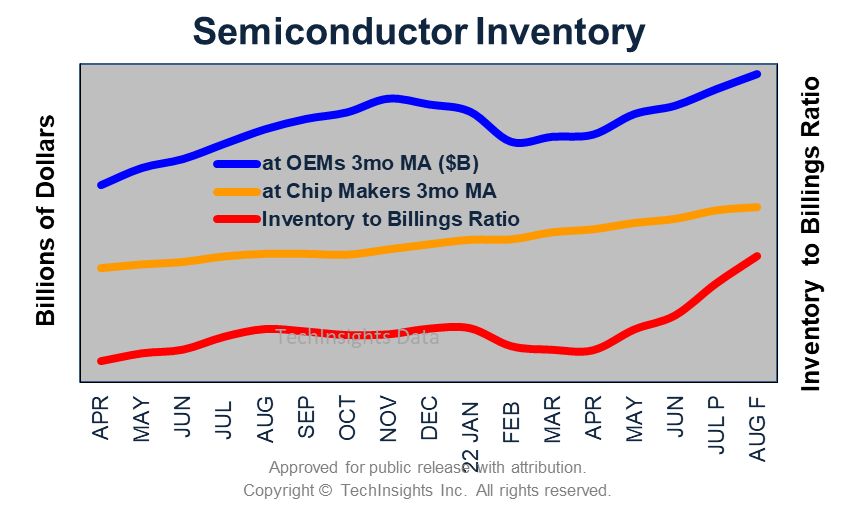

- Semiconductor Inventories are hitting critical levels

Free Newsletter

Get the latest analysis of new developments in semiconductor market and research analysis.

Subscribers can view the full article in the TechInsights Platform.

You must be a subscriber to access the Manufacturing Analysis reports & services.

If you are not a subscriber, you should be! Enter your email below to contact us about access.