It's cold and visibility hit a new low (February update)

Shereen Vaux

- Order activity for semiconductor equipment slipped to a chilly 46 degrees

- All segments, with the exception of Other SOC compute and DAO, slipped a degree last week with memory falling even further into freezing temperatures

- There were some notable changes made to our forecasts this month.

- Semiconductor Equipment for 2023 was upgraded to -12.7% from -14.5%

- Equipment orders have been falling but the backlogs are at extremely high levels and are propelling sales slightly higher

- ICs came in slightly lower in 2022 than our forecast and this weakness is continuing into 2023

- We now forecast 2023 IC sales to decrease 7.6% and units to decrease 1.2%

- Lastly, 2023 OEM Electronics sales are now expected to decrease 2.2%, an upgrade from -4.1% last month

- Semiconductor Equipment for 2023 was upgraded to -12.7% from -14.5%

- TechInsights' CPPI continued to decrease

- DRAM fell

- NAND flat

- MPUs slipped

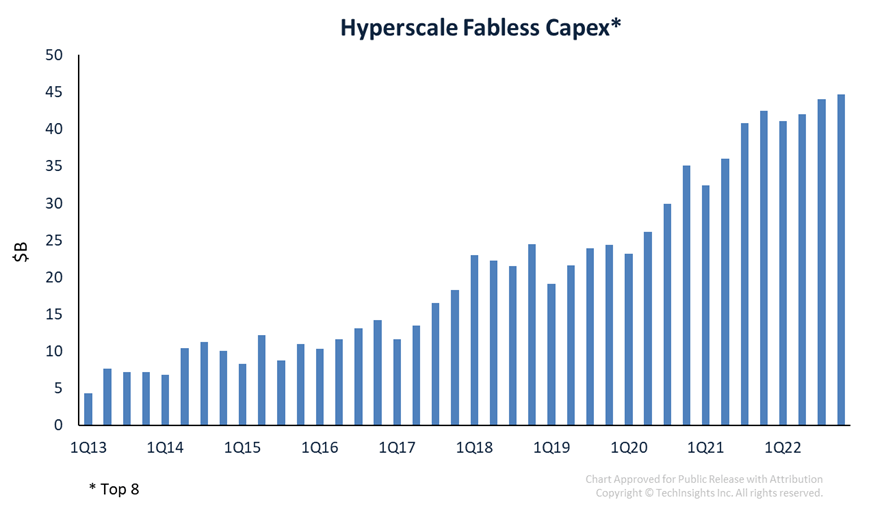

- Hyperscale Fabless CapEx jumped 5% YoY in 4Q22

Free Newsletter

Get the latest analysis of new developments in semiconductor market and research analysis.

Subscribers can view the full article in the TechInsights Platform.

You must be a subscriber to access the Manufacturing Analysis reports & services.

If you are not a subscriber, you should be! Enter your email below to contact us about access.