Global Chip Industry Projected to Invest More Than $500 Billion in New Factories by 2024, SEMI Reports

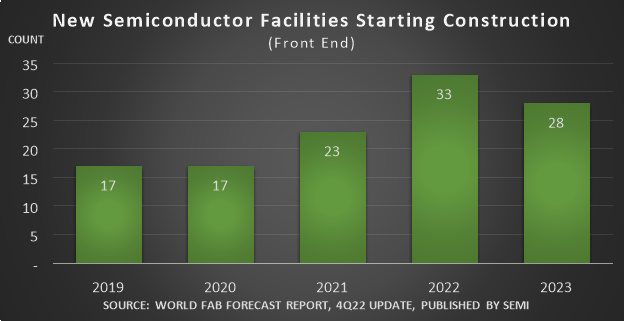

MILPITAS, Calif. — December 12, 2022 — The worldwide semiconductor industry is projected to invest more than $500 billion in 84 volume chipmaking facilities starting construction from 2021 to 2023, with segments including automotive and high-performance computing fueling the spending increases, SEMI announced today in its latest quarterly World Fab Forecast report. The projected growth in global factory count includes a record high 33 new semiconductor manufacturing facilities starting construction this year and 28 more in 2023.

“The latest SEMI World Fab Forecast update reflects the increasing strategic importance of semiconductors to countries and a wide array of industries worldwide,” said Ajit Manocha, SEMI president and CEO. “The report underscores the significant impact of government incentives in expanding production capacity and strengthening supply chains. With the bullish long-term outlook for the industry, rising investments in semiconductor manufacturing are critical to laying the groundwork for secular growth driven by a diverse range of emerging applications.”

New Semiconductor Facilities Starting Construction by Region

The SEMI World Fab Forecast reports data from SEMI’s seven regions:

- In the Americas, the U.S. Chips and Science Act has vaulted the region into the lead worldwide in new capital spending as the government investment spawns new chipmaking facilities and supporting supplier ecosystems. From 2021 through next year, the Americas is forecast to start construction on 18 new facilities.

- China is expected to outnumber all other regions in new chip manufacturing facilities, with 20 supporting mature technologies planned.

- Propelled by the European Chips Act, Europe/Mideast investment in new semiconductor facilities is expected to reach a historic high for the region, with 17 new fabs starting construction between 2021 and 2023.

- Taiwan is expected to start construction on 14 new facilities, while Japan and Southeast Asia are each projected to begin building six new facilities over the forecast period. Korea is forecast to start construction on three large facilities.

The latest update of the SEMI World Fab Forecast report, published this month, lists more than 1,470 facilities and lines globally, including 162 volume facilities and lines with various probabilities that are expected to start production in 2022 or later. Download a report sample.

For more information or to subscribe to the World Fab Forecast and other SEMI market research report, please contact the SEMI Market Intelligence Team (MIT) at mktstats@semi.org. More information on the SEMI market data portfolio is also available online.

About SEMI

SEMI® connects more than 2,500 member companies and 1.3 million professionals worldwide to advance the technology and business of electronics design and manufacturing. SEMI members are responsible for the innovations in materials, design, equipment, software, devices, and services that enable smarter, faster, more powerful, and more affordable electronic products. Electronic System Design Alliance (ESD Alliance), FlexTech, the Fab Owners Alliance (FOA), the MEMS & Sensors Industry Group (MSIG) and SOI Consortium are SEMI Strategic Technology Communities. Visit www.semi.org, contact one of our worldwide offices, and connect with SEMI on LinkedIn and Twitter to learn more.

Association Contacts

Michael Hall/SEMI

Phone: 1.408.943.7988

Email: mhall@semi.org

Free Newsletter

Get the latest analysis of new developments in semiconductor market and research analysis.

You must be a subscriber to access the Manufacturing Analysis reports & services.

If you are not a subscriber, you should be! Enter your email below to contact us about access.