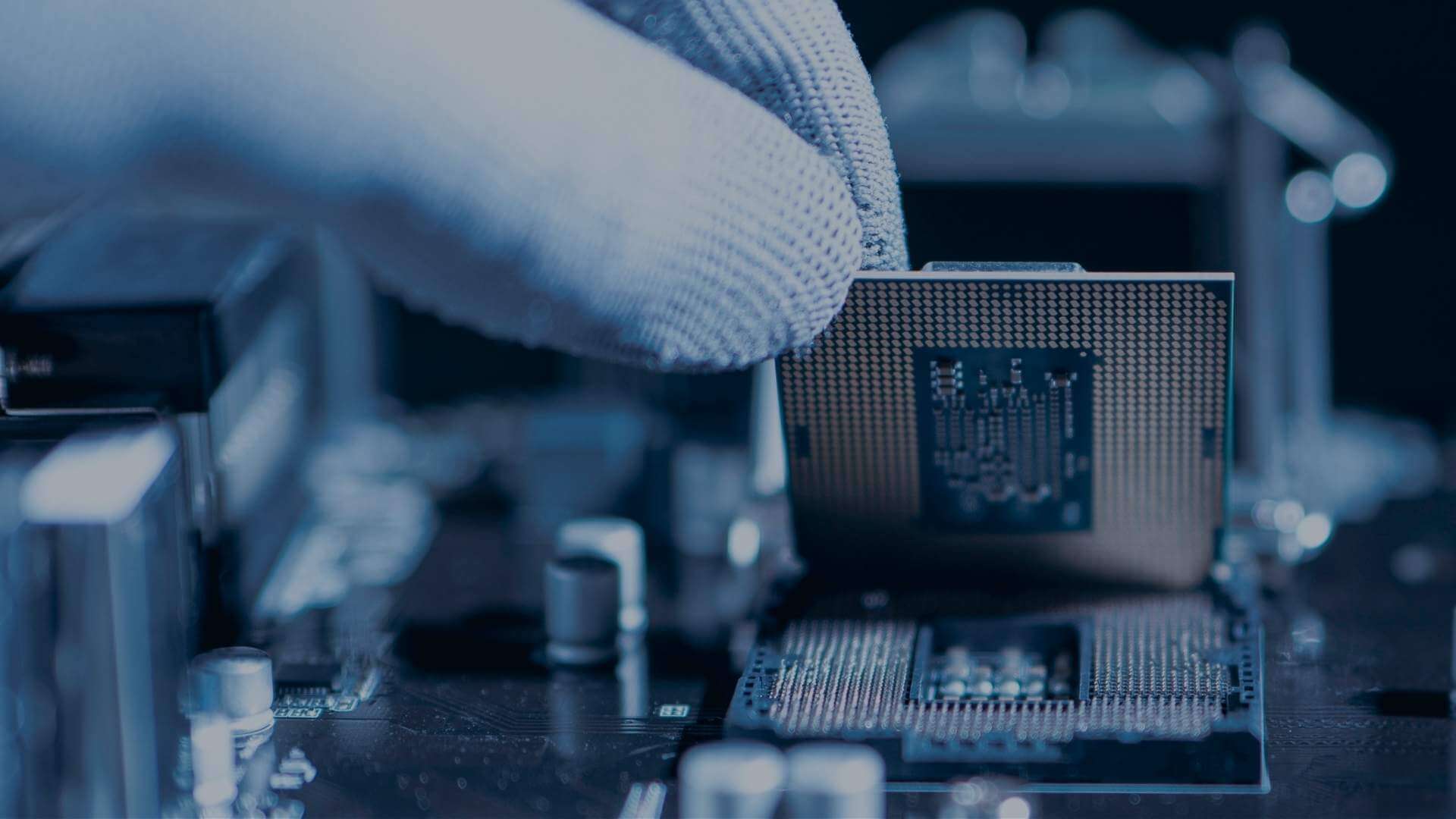

What’s Next for Compute, AI, and Memory?

Start Planning With Confidence.

Get expert analysis on the market forces, technology transitions, and geopolitical dynamics that will define equipment demand in the coming years.

As the semiconductor industry enters a new phase defined by technology transitions, scaling challenges, and shifting global dynamics, Capital Equipment leaders are navigating a rapidly changing landscape. TechInsights’ 2026 Outlook Series provides the forward-looking intelligence needed to anticipate turning points, identify emerging opportunities, and align your strategy with the markets shaping future equipment demand.

This year’s series includes deep-dive analyses across: Compute, Artificial Intelligence, and Memory (DRAM & NAND)

Compute is approaching a critical turning point. Shifting growth drivers, architectural diversification, and geopolitical pressure are converging to reshape the compute landscape. Over the next several years, the industry will face decisions that determine competitiveness for the decade ahead.

Key themes explored:

- Changing demand patterns across PC, server, and edge

- New compute architectures and co-optimization trends

- Market risks and structural shifts

- Global investment and supply chain constraints

Artificial Intelligence Outlook 2026

AI is entering a transformative phase. Model sizes are expanding, workloads are shifting, and datacenter requirements are intensifying. At the same time, geopolitical developments continue to influence global deployment and infrastructure design.

Key themes explored:

- Evolving model architectures and workload dynamics

- Datacenter scaling pressures and infrastructure limits

- Training vs. inference demand patterns

- Global deployment constraints

Memory is entering a new era of scaling, materials evolution, and architectural change. Emerging technologies will reshape DRAM and NAND performance. A mid-decade inflection will be pivotal in determining which players lead or lag over the next technology cycle.

Key themes explored:

- Scaling and new materials innovations

- Architectural shifts impacting DRAM & NAND

- Roadmaps shaping next-generation performance

- Global supply, demand, and geopolitical pressures

Why this matters for capital equipment

- Forecast demand for next-generation tools

Understand the technology transitions driving new equipment requirements. - Align with fab investment roadmaps

Identify the inflection points influencing capacity expansion and process node evolution. - Anticipate materials and architecture-driven changes

Learn how new scaling solutions will affect module-level equipment needs. - Prepare for geopolitical uncertainty

Assess how regulatory, export control, and supply chain decisions will shape global equipment flows.

Each Outlook Report includes:

- Forward-looking market analysis

- Technology evolution and scaling implications

- Competitive dynamics and ecosystem impacts

- Geopolitical constraints and regional investment trends

- Forecasts, data, and strategic recommendations

Designed for:

- Capital Equipment executives

- Strategy & market intelligence teams

- Product planning & roadmap owners

- Technology development groups

- Operations & supply chain leadership

Stay ahead of the market shifts that will define the next technology cycle.