Capital Equipment

Lead with Confidence in a Market That Never Stands Still

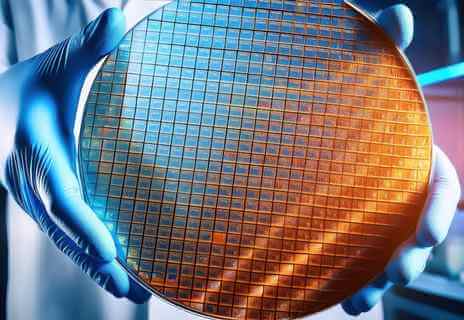

In the rapidly evolving semiconductor industry, staying ahead requires more than just cutting-edge equipment; it demands unparalleled insights and strategic foresight. TechInsights empowers capital equipment providers with comprehensive semiconductor analysis, ensuring you maintain a competitive edge in this dynamic market.

Why Choose TechInsights?

In the fast-paced world of semiconductor manufacturing, having the right insights can make all the difference. TechInsights is the trusted authority in semiconductor analysis, providing capital equipment suppliers with the intelligence needed to navigate technological shifts, optimize processes, and stay ahead of the competition. Our deep expertise, comprehensive data, and advanced analytics empower you to make informed decisions, refine your product strategies, and strengthen your market position.

Industry Insights

- Authoritative Semiconductor Insights: As the industry's most trusted information platform, TechInsights offers in-depth analysis across the entire semiconductor value chain, from silicon fabrication to final production.

- Predictive Process Flow Analysis: Anticipate industry shifts with our predictive analyses, providing foresight into upcoming developments from key industry players.

- Comprehensive Industry Solutions: Our offerings encompass a wide range of analyses, including block diagrams, CAPEX forecasts, circuit design, costing, and critical manufacturing sub-systems such as ceramic electrostatic chucks and silicon carbide components.

Capital Equipment Products

TechInsights provides in-depth analysis of the semiconductor manufacturing landscape, helping capital equipment providers stay ahead of industry shifts. Our comprehensive product offerings deliver actionable insights into key technologies, from advanced packaging and power semiconductors to memory and compute. Whether you need predictive process flow analysis, competitive benchmarking, or deep technical breakdowns, our expertise enables you to optimize your strategy, improve decision-making, and maintain a competitive edge in a rapidly evolving market. Explore our product categories below to see how we can support your business.

Key Features

Capital Equipment R&D

Process and packaging technologies are reshaping semiconductor manufacturing, driving equipment capability requirements across compute, mobile, power, sensor, and storage applications. This product delivers comprehensive technical intelligence through process flow reconstructions, packaging architecture analysis, and high-performance computing teardowns spanning 25-40+ analyses annually. Engineering teams gain step-by-step manufacturing sequences, critical dimensions, materials specifications, and tool requirements from leading foundries and IDMs—revealing exactly how advanced technologies are implemented in production. Coverage extends from 2nm process nodes to 3DIC packaging integration, chiplets, hybrid bonding, and HBM architectures. Interactive CircuitVision platform enables detailed examination with measurement capabilities, while manufacturing cost estimates support economic analysis. This intelligence enables equipment developers to align capabilities with actual industry implementations rather than theoretical roadmaps, anticipating requirements for EUV lithography, advanced patterning, packaging assembly, and precision metrology.

Capital Equipment Sub-Systems and Components

Equipment supply chains demand precision across optical components, mechanics, vacuum systems, and control electronics. This product provides quarterly intelligence on critical subsystems and components through detailed reports covering ceramic components, elastomer seals, electrostatic chucks, pedestal heaters, quartz components, and silicon carbide elements. Market share databases track approximately 150 suppliers globally while driving forces analysis reveals how equipment demand affects subsystem markets. Procurement teams leverage this intelligence for strategic sourcing, supplier evaluation, pricing benchmarking, and supply chain risk assessment. Quarterly updates ensure strategies align with evolving supplier landscapes and component availability dynamics, enabling informed make-versus-buy decisions for precision manufacturing equipment.

Capital Equipment and Manufacturing Markets

Equipment market dynamics require clear visibility for effective positioning and analyst engagement. This product integrates comprehensive market databases covering 250+ equipment subsegments and 200+ suppliers with quarterly and annual WFE, test, and packaging equipment data spanning historical trends through 5-year forecasts. Marketing teams access semiconductor market outlook reports, weekly tactical manufacturing data, monthly strategic bulletins, and processor launch tracking with 1-3 weekly articles. Test connectivity intelligence covers Device Interface Boards, Probe Cards, and Burn-In Sockets with revenue tracking from 2008 through forward projections. Multiple forecast models provide inventory tracking, capacity analysis, CAPEX projections, and supply-demand modeling across silicon, packaging, designs, and reticles. This third-party intelligence supports product positioning, competitive messaging, and credible market share communications while enabling analyst relations teams to engage industry conversations with authoritative data.

Capital Equipment and Manufacturing Strategies

Strategic planning requires connecting equipment trends to downstream semiconductor applications driving customer investments. This product delivers integrated intelligence spanning equipment markets, manufacturing economics, and end-market demand across automotive electronics, datacenter AI infrastructure, mobile technology (100+ tracked from 2001), communications networks, memory markets (comprehensive DRAM/NAND quarterly/monthly analysis), and power semiconductors. Strategy teams access cost modeling for 220+ processes covering NAND, DRAM, and Logic from 2000-2035, fab capacity databases tracking 1,000+ global facilities, and granular application market forecasts revealing how automotive electrification, AI datacenter buildout, mobile innovation, 5G/6G deployment, memory cycles, and power device adoption drive equipment purchases. Manufacturing economics intelligence—including assembly and test modeling, advanced process costs, IC fabrication economics, and power device pricing—reveals profitability dynamics affecting customer decisions. This comprehensive view supports M&A evaluation, white space identification, portfolio planning, and resource allocation grounded in actual market drivers rather than isolated equipment demand forecasts.

Capital Equipment IR Strategies

Investor communications demand equipment market context and component cost visibility for credible earnings discussions and guidance development. This product combines comprehensive equipment market intelligence—quarterly data for 250+ subsegments tracking 200+ suppliers, monthly outlook reports, weekly tactical manufacturing indicators, and 5-year forecast models—with detailed component supply chain data covering approximately 150 subsystem suppliers. IR teams position quarterly results within overall WFE, test, and packaging equipment trends while finance teams leverage critical component intelligence (ceramic, elastomer seals, electrostatic chucks, pedestal heaters, quartz, Si/SiC components) to understand cost dynamics affecting margins and inform procurement budgets. Quarterly updates on supplier market shares and driving forces analysis reveal equipment demand trends influencing component pricing. This combination enables credible earnings communications grounded in third-party market data and accurate financial planning informed by supply chain cost intelligence.

Capital Equipment Sales Strategies

Sales success requires understanding customer end-market drivers connecting equipment opportunities to downstream applications. This product provides extensive intelligence across equipment markets, manufacturing economics, and semiconductor application markets including automotive electronics (electrification, ADAS, infotainment), datacenter AI infrastructure (server architectures, accelerators, HBM), mobile technology (baseband, processors, memory with 100+ technologies tracked), communications equipment (5G/6G infrastructure), memory markets (comprehensive DRAM/NAND supply-demand-pricing analysis), and power semiconductors (SiC/GaN adoption across automotive, datacenter, renewable energy). Sales teams evaluate RFQ attractiveness using customer technology roadmaps, leverage manufacturing economics models for cost-based pricing discussions, access fab capacity databases providing customer context, and identify partnership opportunities across application markets. Rather than transactional responses to specifications, this intelligence enables consultative engagement discussing how equipment capabilities support customer strategic initiatives—whether capturing automotive opportunities, scaling AI infrastructure, maintaining mobile leadership, deploying communications networks, optimizing memory production, or penetrating power semiconductor markets. Manufacturing economics and component intelligence support value-based selling grounded in customer cost structures.

Capital Equipment Sustainability

Carbon emissions transparency is transforming semiconductor manufacturing as customers, investors, and regulators demand comprehensive Scope 1, 2, and 3 reporting across the value chain. This product delivers ISO-Assured carbon intelligence centered on wafer fabrication analysis covering 370+ global fabs and 1,500+ process flows for Logic, DRAM, NAND, GaN, and SiC technologies. Manufacturing carbon modeling quantifies equipment-level energy consumption, process gas usage, and water requirements by tool type—enabling fab-level benchmarking that reveals which process tools and steps drive emissions hotspots. Capital equipment companies leverage this intelligence to understand how their equipment performs in customer fabs, support emissions reduction initiatives, and demonstrate sustainability leadership through data-backed tool efficiency comparisons. Beyond manufacturing, the product extends to packaging carbon analysis covering approximately 30,000 ICs with ISO-Assured methodology, system-level BOM-based emissions assessment for complete products, and rapid device-level analysis through automatic IC identification across 1,300+ processes from 2015-2035. Scenario modeling quantifies impact of yield improvements, abatement systems, and renewable energy adoption while supplier benchmarking reveals carbon performance variations. Quarterly updates ensure current data as sustainability becomes increasingly important in equipment procurement decisions, enabling companies to meet stakeholder requirements, support customer carbon goals, inform equipment design considering emissions implications, and differentiate competitively through comprehensive carbon value chain visibility backed by ISO-Assured tools and methodology.

Stay Ahead in the Semiconductor Industry

Partner with TechInsights to navigate the complexities of the semiconductor landscape with confidence. Our unparalleled insights and analyses equip you with the knowledge to make informed decisions, optimize your equipment strategies, and maintain a competitive edge.

Intel Panther Lake on Intel 18A: Strategic & Geopolitical Analysis

Explore Intel Panther Lake on Intel 18A, examining advanced-node execution, IDM 2.0 credibility, and strategic implications for the global semiconductor ecosystem.

iPhone 17 Teardown Reveals Major STMicroelectronics IR Sensor Redesign

The iPhone 17 Pro Max introduces a major IR sensor redesign. See how STMicroelectronics’ new architecture reshapes biometric imaging.

Huawei Mate 80 Pro Max Teardown Confirms Kirin 9030 Pro on SMIC N+3

TechInsights’ teardown of the Huawei Mate 80 Pro Max confirms the Kirin 9030 Pro on SMIC’s N+3 process and reveals major upgrades in display, cameras, and connectivity.