Posted: February 27, 2018

Contributing Authors: Marty Bijman

Recently, IAM’s Timothy Au posted a blog providing a look at Uber’s portfolio. The blog references Uber’s portfolio makeup, and provides a chronicle of their IP events over the last 5 years. I thought I’d add to the story with some competitive landscape analysis.

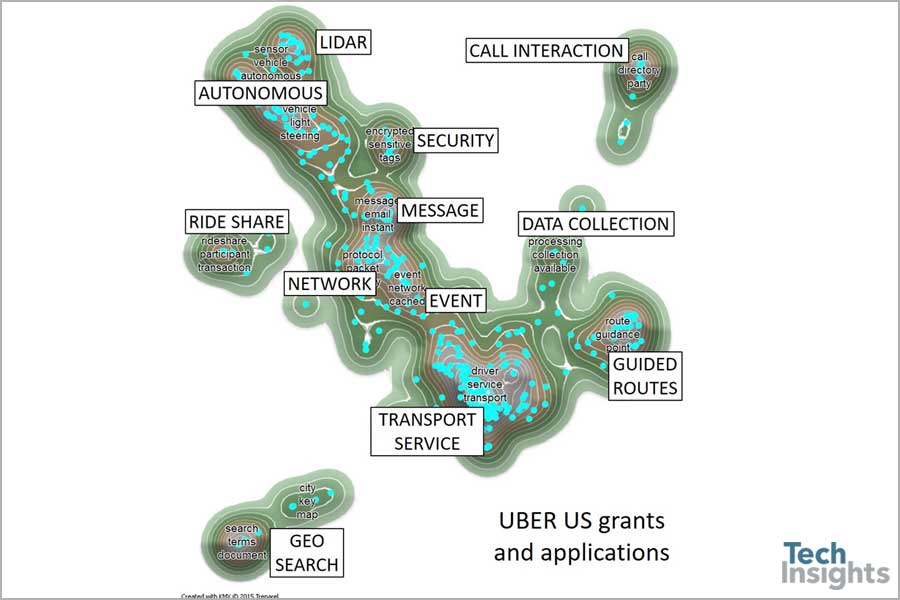

So, what does Uber’s landscape look like? In Figure 1, the core area is transport service, which has arms for call interaction, guided routes, geo search, and ride share. The autonomous arm in the top left is somewhat separate, as it connects to transport service through a series of technologies: event, network, message, and security.

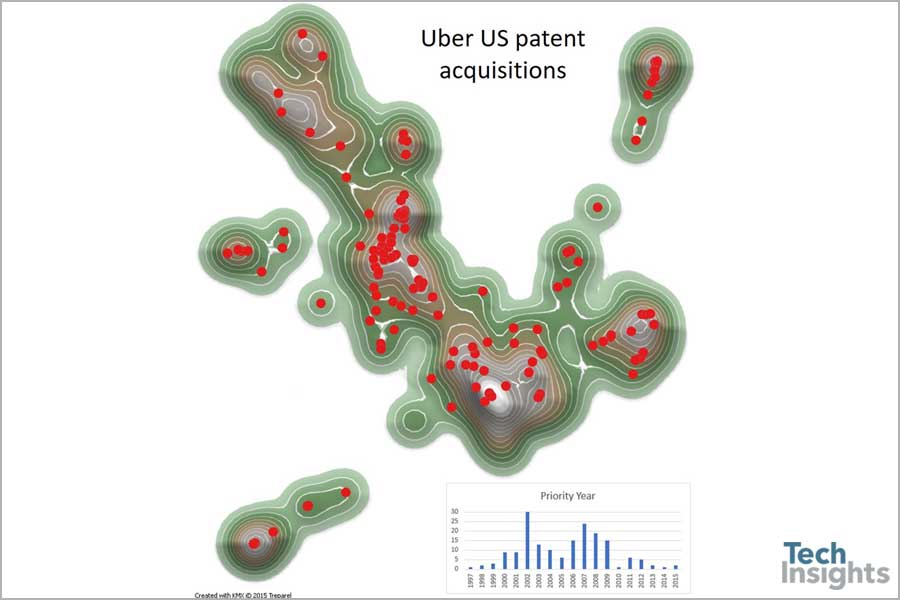

What technologies have Uber acquired? How old are these patents? Those patents in Uber’s portfolio in Figure 1 that are acquired are shown as red dots in Figure 2. These acquired patents appear throughout the portfolio, although modestly in the core area of transport services, and autonomous. The bar chart indicates that the priority years of these acquired patents is bimodal, centered around 2002 and 2007.

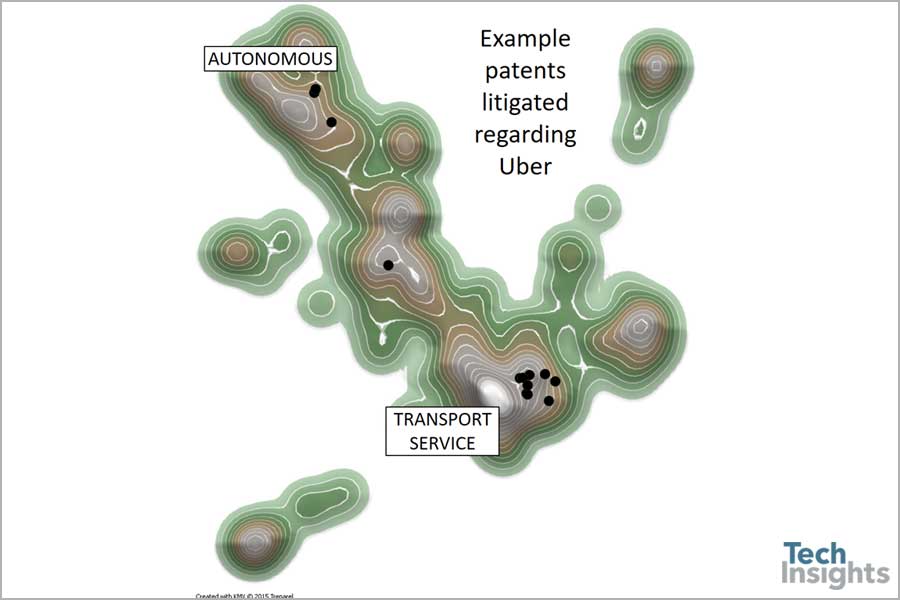

What technologies are companies litigating against Uber? Figure 3 shows some example patents that have been litigated regarding Uber, which are mostly in the core area of transport services, and some in autonomous.

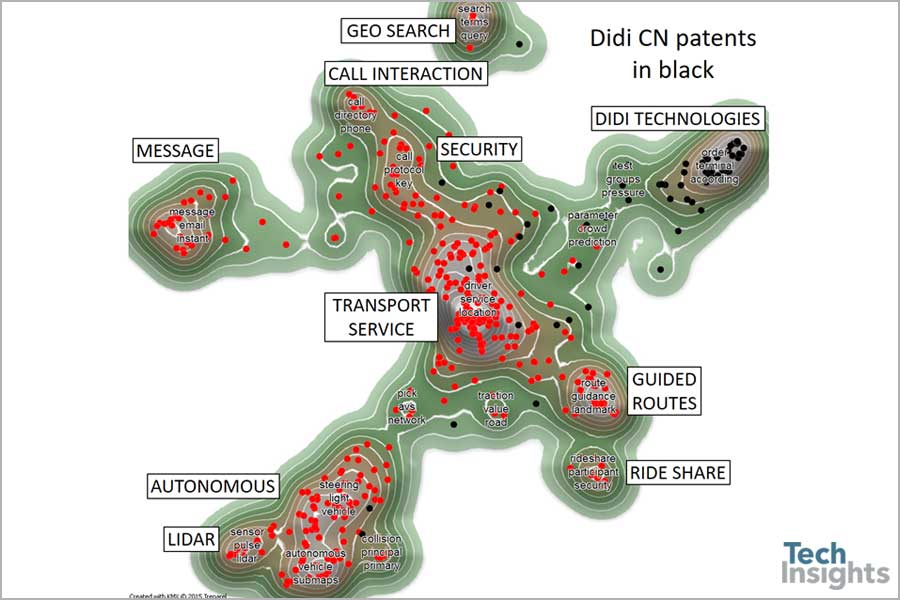

The IAM blog also notes that Didi Chuxing (Didi) of China is bulking up its portfolio. What is interesting is that they appear to be the only immediate competitor that is doing this in transport service, as shown in table 1. There are many companies with patents in autonomous vehicles.

| Company | Active US patents / applications | % of US portfolio acquired | Global patents | Market |

|---|---|---|---|---|

| Uber | 332 / 184 | 41% | 262 | Transport Services. Autonomous. |

| Lyft (with GM) | 5 / 4 | - | 5 | Transport Services. |

| Curb | 0 / 1 | - | 4 | Transport Services. |

| Grab | (none found) | Transport Services. | ||

| Hailo | (none found) | Transport Services. | ||

| Didi Chuxing (China) | - | 74 | Transport Services. | |

| Ola (India) | (none found) | Transport Services. | ||

Table 1: Didi Chuxing building portfolio in transport service

Also, Didi is innovating in an area different than Uber! In Figure 4, notice the new arm that appears on the right of this new landscape, which combines Uber US and Didi CN patents. Either Didi is innovating in other technology areas than Uber, or the jargon used by translated Didi CN patents is different than that used by Uber.

What other companies are patenting in US regarding transport services?

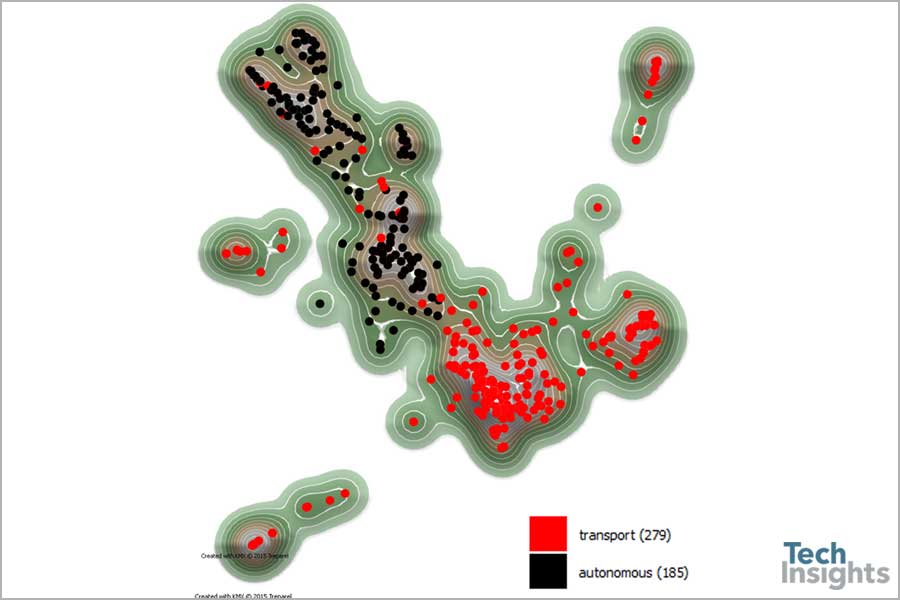

First, let’s consider only Uber patents regarding transport service, and exclude those about autonomous. In Figure 5, the black patents are autonomous, and the red are transport services and related technology. This shows that 279 patents remain that are more so about transport services.

Next, we find similar US patents using TechInsights’ proprietary search tools. Matches were found for 818 US patents with strong scores, including 29 companies with 5 or more patents similar to Uber transport services.

| Company | Count |

|---|---|

| Uber | 279 |

| Alphbet | 88 |

| Microsoft | 73 |

| Amazon | 47 |

| ATT | 35 |

| IBM | 21 |

| Apple | 19 |

| Verizon | 16 |

| RPX | 14 |

| 11 | |

| Qualcomm | 10 |

| Altaba | 9 |

| Oracle | 9 |

| UPS | 9 |

| Cubic | 8 |

| Company | Count |

|---|---|

| SAP | 8 |

| Veveo | 8 |

| Cisco | 7 |

| Ericsson | 7 |

| HP | 7 |

| LG | 7 |

| PayPal | 7 |

| Amadeus | 6 |

| Intel | 6 |

| IV | 6 |

| Adobe | 5 |

| GM | 5 |

| Lytx | 5 |

| Nokia | 5 |

| ...Others | 103 |

Table 2: 29 companies with 5 or more patents similar to Uber transport services

As I view this list in Table 2, it is somewhat familiar, as the US reassignments indicate that Uber has purchased patents from AT&T, HP, and Microsoft.

Bottom line, it would appear the landscape of transport services extends beyond Uber’s immediate competitors. The diverse technologies that combine to create transport services clearly have innovators throughout the industry.