Posted: February 10, 2017

Contributing Authors: Ray Angers, Goran Grbic and Martin Bijman

Microsoft recently launched a new service to their cloud customers offering protection against patent infringement lawsuits. TechInsights was given early access to the patents being made available to Microsoft’s customers via the Azure IP Advantage program. We used our IP analytics capabilities to evaluate some important metrics of the portfolio and compare it to a selection of Microsoft’s leading competitors.

What we looked at

The preliminary asset list contained approximately 7,500 patent publications, including over 4,100 US grants and 100 US applications which were the focus of our analysis. We assessed these assets against several factors that we consider important to ensure that the Microsoft Azure IP Advantage portfolio will be an effective counter-assertion resource for Microsoft Azure clients. These factors included portfolio composition, patent age, forward references, innovation, global coverage, and likelihood of use. Based on this initial look, we concluded that the Microsoft Azure IP Advantage portfolio accurately reflects the quality, diversity, and technology coverage of the full Microsoft portfolio.

Are there any gaps in coverage of the full Microsoft portfolio?

Are there any gaps in coverage of the full Microsoft portfolio?

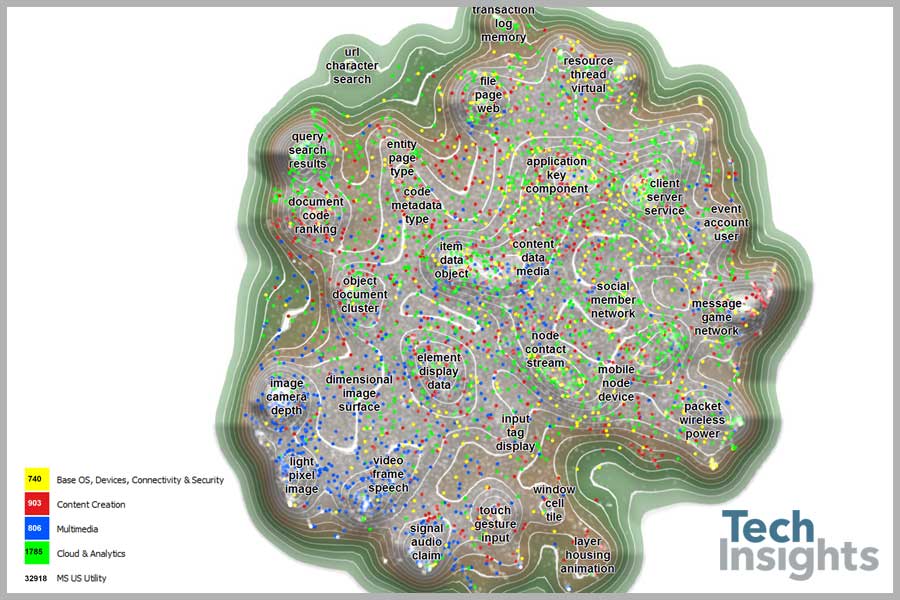

To compare the Azure IP Advantage patents against Microsoft’s entire portfolio we generated a patent landscape; a graphical representation of the assets grouped by technology concepts. Each dot on the landscape represents a single patent publication, with the Azure IP Advantage publications color-coded according to technology category. The remaining 32,000+ Microsoft US patents are faded to improve readability.

What we see is that the Azure IP Advantage patents appear across the entire landscape, which indicates that it accurately reflects the full Microsoft portfolio in terms of technology coverage. Furthermore, no significant gaps in coverage are observed. This suggests that the assets selected for inclusion in the Azure IP Advantage portfolio are a true representative subset of the overall Microsoft portfolio. It appears that Microsoft has carefully selected assets from their portfolio, and also weighted it towards Cloud and Analytics technology patents as these may be of most use to Azure customers.

Are the patents used in industry?

Are the patents used in industry?

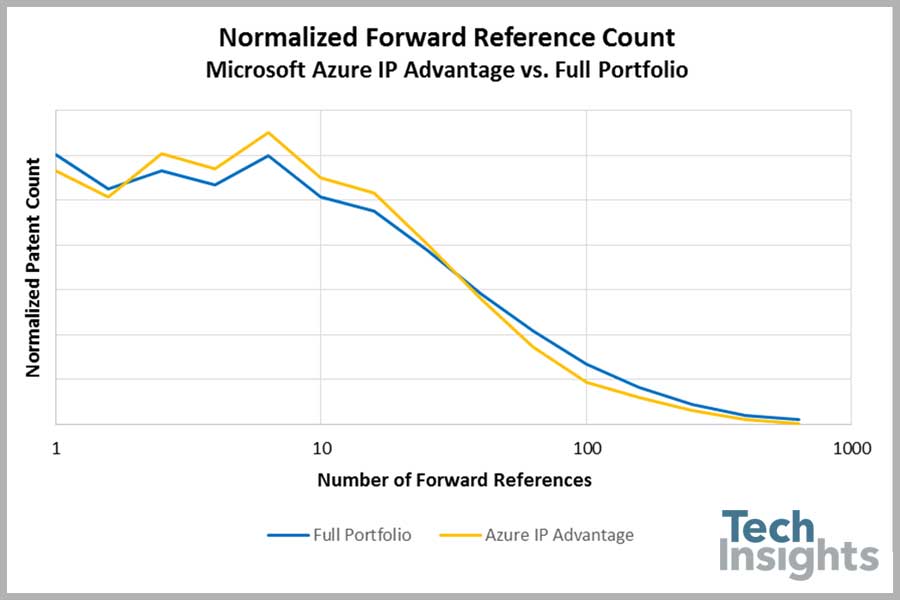

Forward references is another metric used as an indication of patent value and, based on TechInsights’ past experience, this appears to be the case. In one study where we inspected more than 3,700 US assets litigated over a five year period it was found that only 8% of these had no forward references. Over three quarters of the patents asserted had six or more forward references.

Comparison of the normalized forward references of Azure IP Advantage patents to the full Microsoft portfolio shows comparable distributions.

While sophisticated IP analytics provides rapid insight into large patent portfolios, it cannot replace the value of having experienced experts review individual patents to assess patent strength. TechInsights’ engineers reviewed over 500 US granted patents in the Microsoft Azure IP Advantage portfolio and rated them in terms of likelihood of use. Over 16% of these were rated highly in terms of likelihood of use.

How does the innovation in the Azure IP Advantage portfolio compare to other cloud companies?

To assess innovation we compared the cloud patents filed by six market leaders with priority dates from 1997 to 2010. Only older patents were considered since early innovators are often the market leaders in the technology business. Patents were ranked by age in 18 technology peaks identified with the help of a patent landscape.

What we concluded was that the full Microsoft portfolio ranked first in innovation and found that the Microsoft Azure IP Advantage portfolio holds its own against leading competitors in the Cloud patent ranking.

| Microsoft | IBM | Microsoft Azure IP Advantage | Oracle | Amazon | VMware | ||

|---|---|---|---|---|---|---|---|

| 28% | 22% | – | 18% | 15% | 9% | 9% | % of weighted ranks |

| – | 24%* | 22%* | 19% | 16% | 9% | 9% | % of weighted ranks |

| *This is within the analysis margin of error for the initial 7,500 patents evaluated. Analysis will be repeated when additional 2,500 patent assets are provided | |||||||

Conclusion

TechInsights’ assessment of the Microsoft Azure IP Advantage portfolio found that it surpasses market rivals like Amazon and Google in Cloud technology. Microsoft’s portfolio ranks at the top of the industry, and its Azure IP Advantage portfolio reflects the same strength, diversity and quality that Microsoft is known for. Microsoft Azure IP Advantage will be a valuable resource available to Azure customers looking to ensure IP protection in the rapidly growing and highly competitive market of Cloud applications.

If you require any support to identify patents to acquire from the Microsoft Azure IP Advantage Portfolio, click here.