Evaluating and Comparing the Latest Ethernet Switches and PHY Chips

The Ethernet market is marked by technology transitions, which often result in large shifts in vendor share. Over the past several years, large data-center operators have increased the pace of technology innovation, creating markets for new speeds and new physical layers. These dynamics are behind the introduction of high-density 100G Ethernet switch chips, which also serve the new 25G and 50G Ethernet standards. The same operators also have a huge appetite for data-center interconnect (DCI) bandwidth, creating early demand for 400G Ethernet.

In Ethernet switches, Barefoot Networks, Broadcom, Cavium, Centec, Innovium, Marvell, and Mellanox are competing to win market share in data centers. These vendors are adding 100G Ethernet support along with new features for SDN and NFV. For data centers, most PHY development now focuses on 100GbE retimer chips using 25Gbps serdes technology, with 50Gbps PAM4 on the horizon.

The large size of the Ethernet switch and PHY market continues to keep it a competitive environment. "A Guide to Ethernet Switch and PHY Chips" breaks this market into three growth segments:

- Data-center switch chips

- 10GbE PHYs for copper (10GBase-T)

- 100GbE gearbox PHYs and 25Gbps retimers

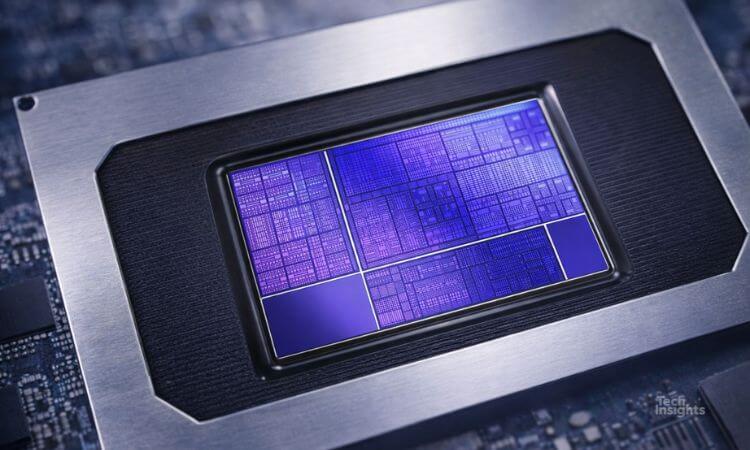

Unlike typical market research, this report provides technology analysis and head-to-head product comparisons. Which chips will win designs and why? How will these vendors be positioned as 100GbE ramps? Only TechInsights’ unique technology analysis can provide this forward-looking view.

We Sort Out the Technology and the Key Vendors

“A Guide to Ethernet Switch and PHY Chips” begins with an extensive overview of this dynamic market. The report provides tutorials that help you decipher the myriad of acronyms and Ethernet standards. We explore the target markets and applications for Ethernet silicon, followed by an explanation of the common attributes of these products.

Following these introductory chapters, the report delivers a complete chapter on five leading switch vendors: Barefoot Networks, Broadcom, Cavium, Intel, and Marvell. Each vendor chapter includes company background information, full details of announced products, a discussion of the vendor’s roadmap where available, and our conclusions about the vendor and its products. Then, for each product segment, we include a chapter covering other vendors and a chapter comparing the products in the segment.

Product-segment chapters include coverage of switch chips and PHY chips. We cover switch chips from Centec, Innovium, and Mellanox. For the physical layer, we focus on 10Gbps Ethernet-over-copper chips and 100Gbps gearbox PHYs and retimers. Covered PHY vendors include Aquantia and Inphi. Finally, we offer our outlook for the leading vendors in each segment and for the overall market.

What's new

Updates to the Thirteenth Edition of "A Guide to Ethernet Switch and PHY Chips" incorporate new announcements made since the release of the previous edition.

- Coverage of Broadcom’s new Tomahawk II, Trident 3, and Jericho+ Ethernet switch chips

- Coverage of Marvell’s Bobcat 3 25G Ethernet switch

- Coverage of Barefoot Networks’ Tofino programmable switch

- Coverage of Innovium’s 12.8Tbps Teralynx switch

- Full-chapter coverage of Cavium’s Xpliant programmable switch

- 2016 market size and vendor share for GbE switch chips, 10GbE switch chips, and 10GbE PHYs

- Updated market forecasts for GbE through 100GbE switch chips as well as 10GbE and 100GbE PHYs, from 2016 - 2021

- Product comparisons updated to include the latest chips

Executive Summary

This report examines Ethernet switch chips and physical-layer (PHY) chips for data-center applications. We look at 10G Ethernet (10GbE), 25G Ethernet (25GbE), and 100G Ethernet (100GbE) switch chips. Some 100GbE products enable draft-standard 200G Ethernet and 400G Ethernet rates as well. We cover 10GBase-T (copper) PHYs as well as 100GbE gearbox PHYs and retimers. The newest 10GBase-T chips also handle the new 2.5Gbps and 5Gbps standards for twisted-pair cabling.

The market for Ethernet chips was once dominated by enterprise applications but now relies on cloud data centers for growth. In data centers, virtually every OEM and ODM system design uses ASSPs. Cisco’s ASIC-based Nexus products are the major exception, but even this line uses ASSPs in some models. The rising white-box movement also threatens to loosen OEMs’ hold and shift the market toward bare-metal systems built by ODMs. Hyperscale-data-center operators are driving the early ramp in 100G Ethernet switch chips, which enable 25G and 50G Ethernet for server access.

In 2016, however, 10GbE still dominated data-center switch shipments. We estimate combined 10GbE/40GbE switch- and PHY-chip revenue reached $1.4 billion in 2016, driven by fixed-configuration switches for top-of-rack (ToR) and leaf/spine use.

Although we refer to them as optical PHYs, 10Gbps serdes components also serve in SFP+ direct-attach cabling. Because new ASSP and ASIC designs integrate these serdes, we believe the market for standalone optical PHYs has peaked. By contrast, switch chips won’t integrate 10GBase-T PHYs in the foreseeable future. As a result, 10GBase-T PHY revenue grew nearly 60% in 2016. An emerging opportunity exists in 100GbE PHYs based on 25Gbps serdes technology. Owing to signal-integrity challenges, we expect an increasing portion of switch designs will require retimers between switch ASSPs/ASICs and optical modules.

The vendor landscape for data-center switch chips comprises one dominant supplier, several incumbents with limited share, and a number of new entrants vying for a piece of this fast-growing market. Technology discontinuities include new Ethernet data rates — 25Gbps, 50Gbps, 200Gbps, and 400Gbps — as well as software-defined networking (SDN). The latter trend has led to new programmable switch architectures that are more flexible than traditional fixed-pipeline designs.

Broadcom gained share in the 10GbE transition, and it controlled more than 90% of the market by revenue in 2016. The company’s Trident family dominates ASSP-based data-center switch designs for 10GbE. In 2015, Broadcom shipped its first Tomahawk switch for 100GbE designs, and it saw revenue ramp in 2016. Avago’s acquisition of Broadcom, which closed in February 2016, has had little impact on the Ethernet switch and PHY products. The company continues to invest in three different switch architectures serving the data center. One is Trident 3, an evolution of the venerable Trident family that adds programmability.

Marvell is Broadcom’s top competitor across the full Ethernet switching market, but it fell behind its archrival in the data-center segment. Following 2016 management changes, the company has refocused its Ethernet strategy, and it brought its first 25G/100G Ethernet switch (known as Bobcat 3) to production. Still, Marvell has yet to match the breadth of Broadcom’s data-center portfolio.

Among the new entrants is Cavium, which was the first vendor to begin production of a customer-programmable 100GbE switch chip. This product line came from its spin-in of Xpliant. Cavium is now sampling a second-generation design that competes more directly with Trident 3.

Barefoot Networks is another newcomer with a programmable 100GbE design. It stands out by supporting an open programming language called P4. The startup supplies a P4 compiler that customers can use to generate code for its Tofino switch chip.

Innovium is the latest startup to disclose a data-center switch chip. It was first to announce a chip that handles the new 200G and 400G Ethernet standards, but that chip had not yet sampled at press time.

InfiniBand leader Mellanox is a recent entrant in Ethernet switch chips and is shipping 100GbE products. The company has strong technology and an excellent record of product execution. It has primarily supplied system-level switch products, however, limiting its impact in the chip market.

Based in China, privately held Centec initially targeted Carrier Ethernet designs, but its newest products also address data-center designs. In 2016, it reached production with its first 10GbE switch chip, which includes 100GbE uplink ports.

Before 2015, Intel shipped conventional 10GbE/40GbE switch chips that competed with those from Broadcom and others. The company’s most recent product, however, is a unique chip that combines multiple host controllers with an Ethernet switch. The FM10000 (code-named Red Rock Canyon) works with Xeon server processors in network appliances.

In addition to switch chips, Broadcom and Marvell offer PHYs for 10GbE and 100GbE. PHY specialists that serve the data center include Inphi, which was first to market with a 100GbE gearbox chip developed in CMOS technology. Privately held Aquantia emerged as an early leader in 10GBase-T and pioneered the NBase-T specification, which later became the basis for the 2.5G/5G Ethernet standard.

This report is written for:

- Engineers designing Ethernet switch products or systems that embed an Ethernet switch or PHY

- Marketing and engineering staff at companies that sell related chips who need more information on Ethernet chips

- Technology professionals who wish an introduction to Ethernet chips

- Financial analysts who desire a detailed analysis and comparison of data-center Ethernet semiconductor companies and their chances of success