Xiaomi Poco C40 - A Different Kind of Poco

The JQL Technology JR510 applications processor is not the only news.

Stacy Wegner

We have identified hundreds of manufacturers throughout the years and are always looking to expand our BoM Database library. So when we heard the Xiaomi Poco C40 would have a new processor from JLQ Technology, the Poco C40 jumped to the top of our list for a Quick Turn Teardown.

Xiaomi Poco C40

JLQ Technology is a joint venture started in 2017 with four investors: Qualcomm (24%), Datang Telecom Tech (24%), JAC Capital (34%), and Wise Road Capital (17.4%). In 2021 Datang Telecom sold 6.7% of of its share in JLQ.

Sravan Kundojjala, an Associate Director and Principal Industry Analyst at Strategy Analytics, adds what they have been seeing from JLQ:

“Strategy Analytics’ Handset Component Technologies (HCT) service tracks JLQ’s smartphone apps processor (AP) and baseband shipments by OEM closely. The HCT service estimates that JLQ shipped 0.5 million APs and captured just 0.02 percent revenue share in 1H 2022. In addition, Strategy Analytics believes that the JLQ unit can help Qualcomm withstand mid-range competition from MediaTek. However, given the growing geopolitical friction between the USA and China, we believe that regulators will watch Qualcomm’s ties with JLQ closely in the coming quarters. We note that JLQ shares common investors with another China-based cellular chip company Unisoc, complicating things further.”

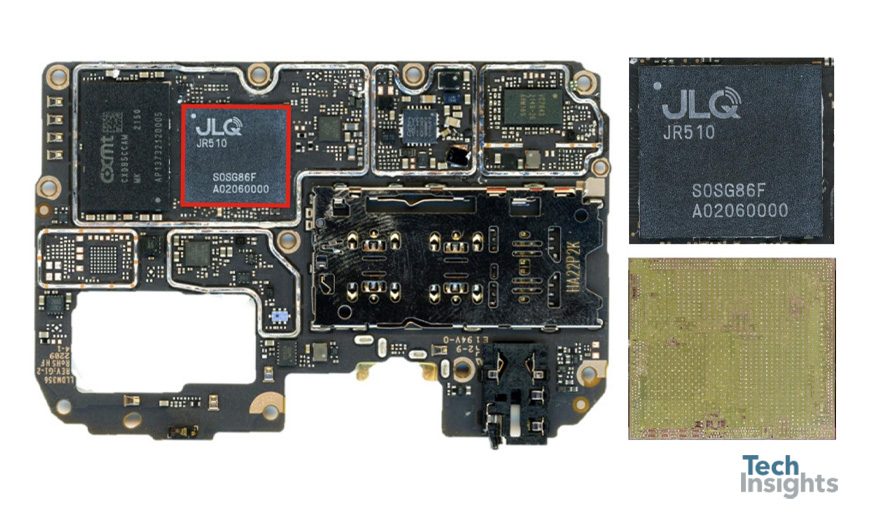

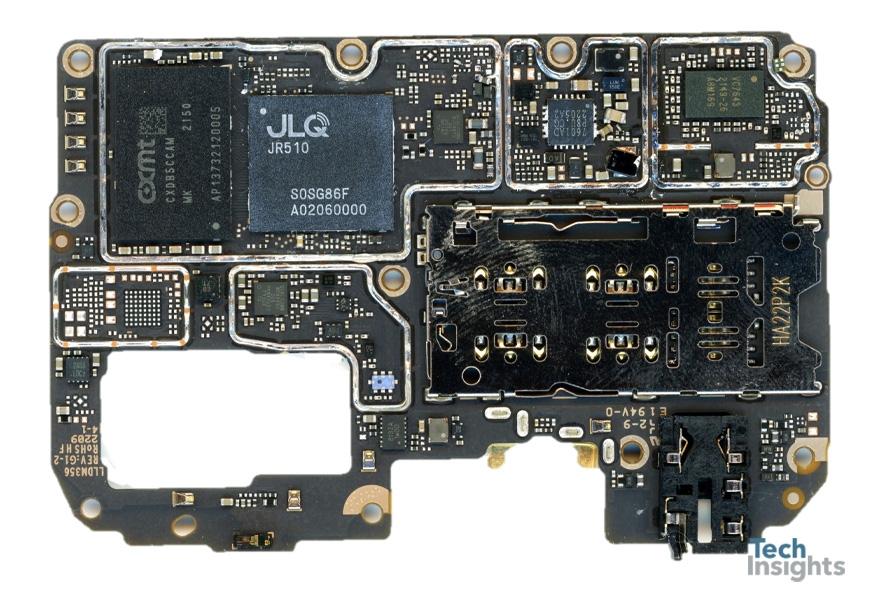

Some of Qualcomm’s role in JLQ Technology is found in the new JLQ JR510 applications/baseband processor used in the Poco C40. The JLQ JR510 IC package markings are large and visible, as are the Qualcomm die markings and die part number, seen after the analyst decapped the IC. We have not seen this new Qualcomm die in any of the 200 unique Qualcomm processors in the Teardown library.

JLQ Tech JR510 Applications / Baseband Processor, ChangXin Memory Technologies (CXMT) 4 GB LPDDR4x DRAM

The JR510 processor is not the only new IC in the Poco C40. We also identified two new memory chips from Chinese manufacturers ChangXin Memory Tech (CXMT) (4 GB LPDDR4x memory), and a new Yangtze Memory (64 GB 3D NAND with 2nd gen of Yangtze Xtracking eMMC 5.1). In the Yangtze memory, both the NAND and the Memory controller die are the same die used in the memory package used in the Huawei Enjoy 20e.

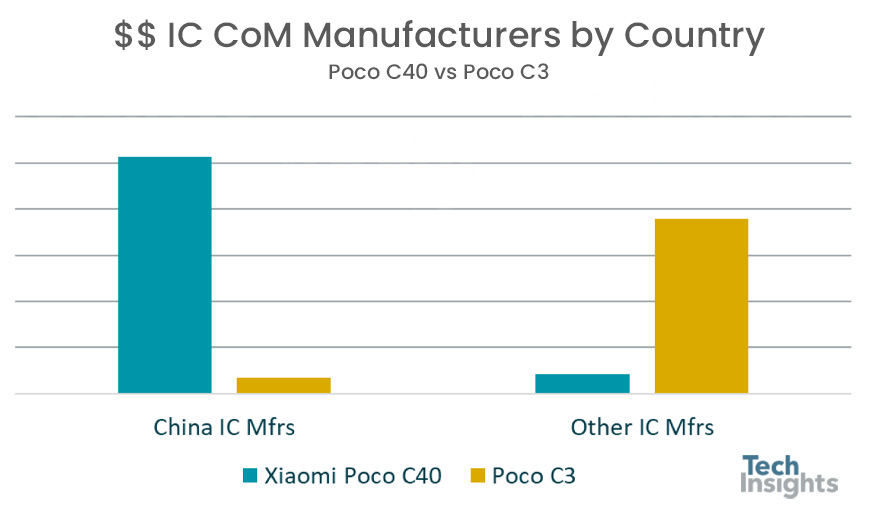

Although Qualcomm also provides WiFi, power management, and an RF transceiver, the more important news is that the majority of the IC packages in the Poco 40 are supplied by Chinese manufacturers. From an IC package perspective, at least 90% of QTT IC bill of materials is for Chinese parts.

$$ IC CoM Manufacturers by Country, Poco C40 vs Poco C3

For context, the first Xiaomi Poco C-series we analyzed was the Poco C3. The physical specifications between the two Poco mobile phones are comparable – one exception being the Poco C3 has a smaller display size. In addition, the Poco C3 is designed with a Mediatek platform and had an estimated IC BoM that had less than $5 from Chinese IC manufacturers.

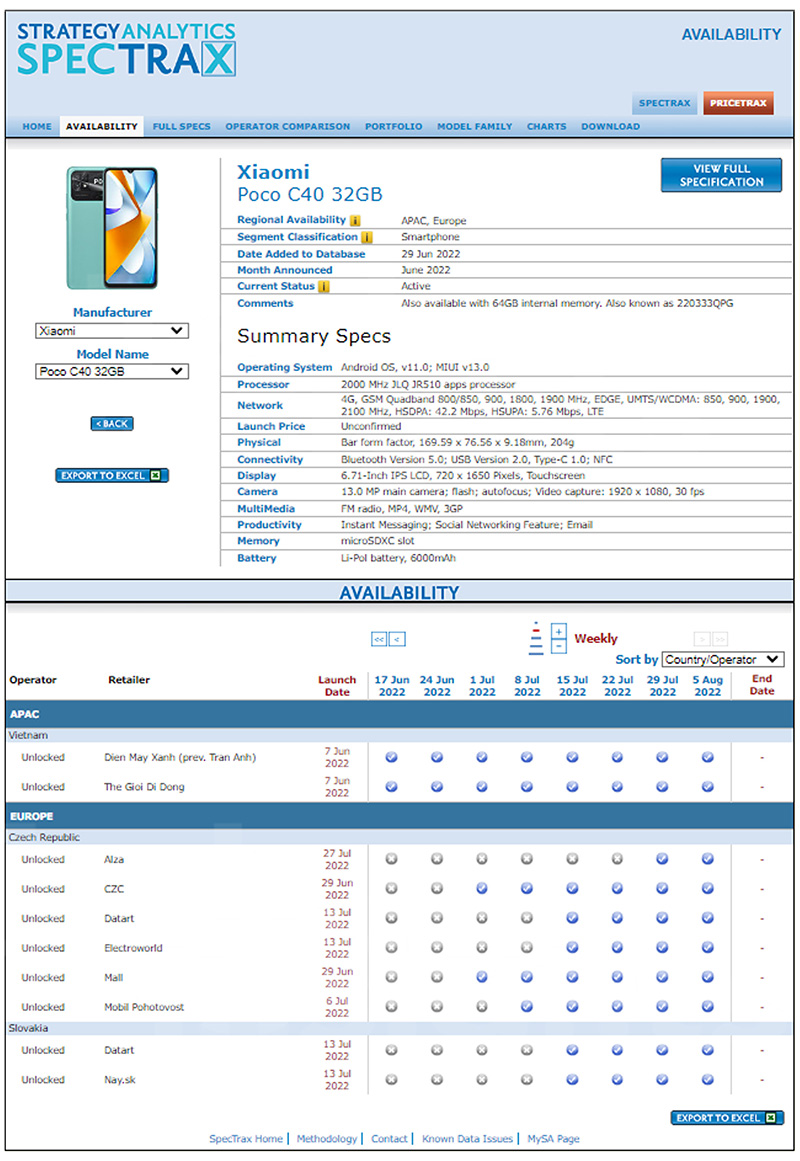

The Poco C3 was released in 2020 and is still available in India today. The Poco C40 was released in June of this year. According to the Strategy Analytics Spectrax, the Poco C40 is available in Vietnam and a few countries in Europe. Xiaomi will also bring the Poco C40 to India, the 2nd largest mobile market, sometime in September. The Poco C40 will validate the multi-Chinese-component-centric design in a market where many phones are designed with one brand solutions like Qualcomm, Mediatek, and Samsung.

Strategy Analytics Spectrax - Xiaomi Poco C40

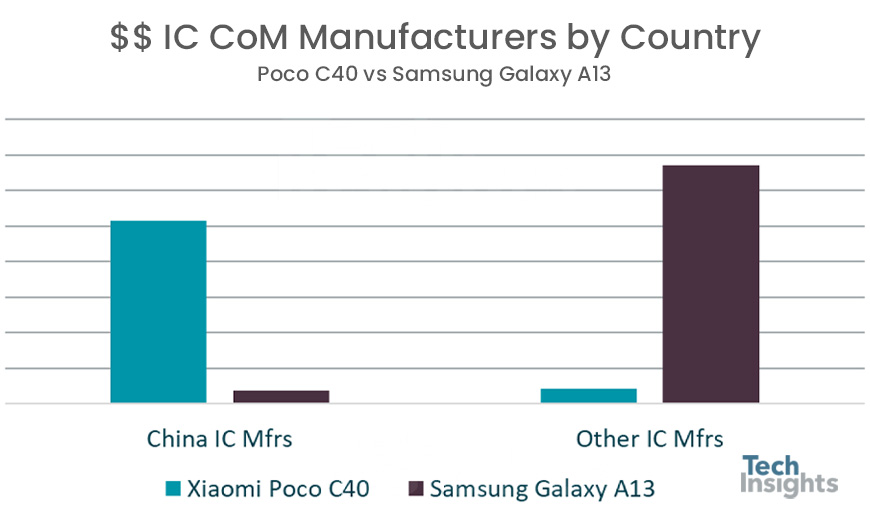

One Xiaomi competitor, Samsung, also competes in low-retail and budget phones in these regions. One such model is the Samsung Galaxy A13, another sub-$175 mobile phone with a slightly higher price tag than the Poco C40. The higher retail price of the Samsung Galaxy A13 offers the consumer an Exynos 850 processor with a quad-rear camera system built around a Samsung S5KJN1 50 MP image sensor, versus the Poco C40’s dual rear camera.

The two phones’ cellular band coverage is very similar, but they support different LTE categories – the JR510 supports LTE Cat 7, while the Exynos 850 supports the faster LTE Cat 13. Both the JR510 and Exynos 850 are built with ARM Cortex – A55 cores, the processors are different in physical size, too. The JQL JR510 die is manufactured with 11-nanometer process technology and is larger than the Samsung Exynos 850 die. The larger JR510 estimated price is almost $2 more than the Samsung Exynos 850.

But even though the JR510 has a higher price, comparing the estimated RF Front-end and processor spends in both phones, the slower Cat 7 JR510 processor and RF components price in the C40 total is $6 less than the same functions in the Samsung Galaxy A13. Furthermore, in the Poco C40, 80% of the IC costs for the processor and RF components are for Chinese IC manufacturer brands.

$$ IC CoM Manufacturers by Country, Poco C40 vs Samsung Galaxy A13

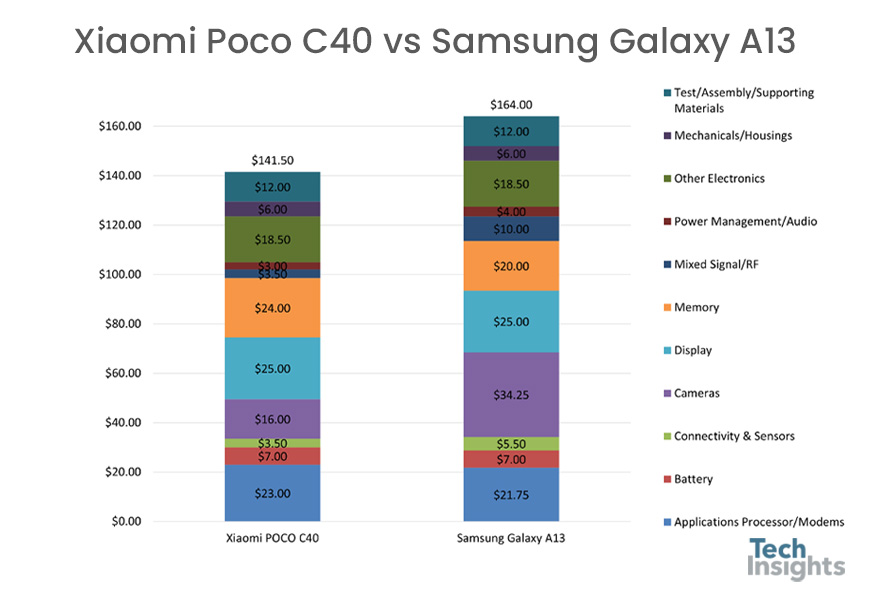

Estimated BoM $$ of the Xiaomi Poco C40 and the Samsung Galaxy A13

To wrap up, the Poco C40 is not just an entry-model mobile phone with a new processor. It is also a mobile device from a popular mobile OEM that has designed a phone with a bill of materials heavily supported by Chinese IC brands. The Xiaomi Poco C40 is a low-budget smartphone and an opportunity for Xiaomi to validate a mobile phone outside of China with a bill of materials with many more Chinese IC manufacturers than ever before.

Xiaomi Poco C40 Main Board - Front

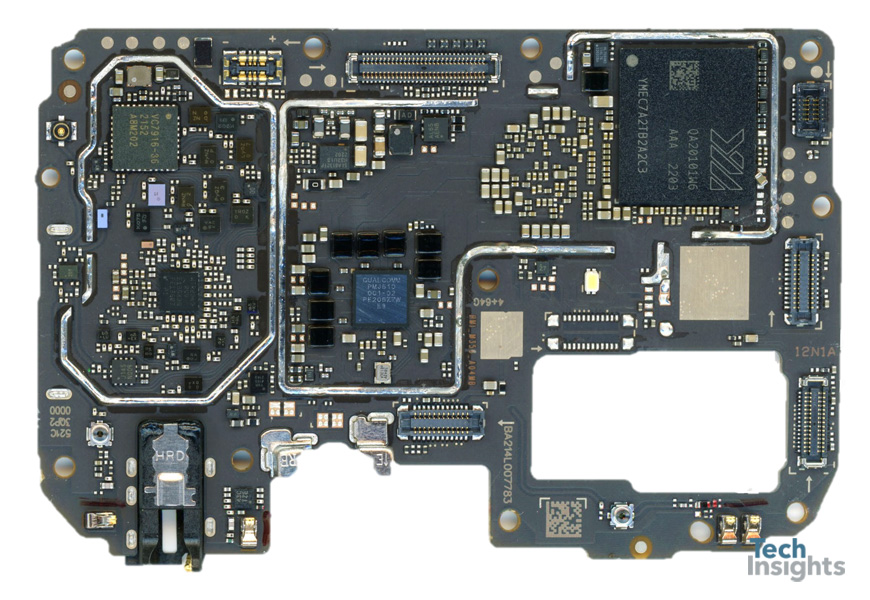

Xiaomi Poco C40 Main Board - Back