Surprising Near-Term versus Long-Term Decadal Trends

G. Dan Hutcheson

The Chip Insider®

Near-Term versus Long-Term Decadal Trends: As everyone knows, the near-term picture has been darkening for some time. DRAM and Foundry markets started to shift out of the shortage situation in 2Q22, as capacity gains increased supply and economic slowing cooled demand. Demand was also hit by inflation. This was more than the Russia-Ukraine war. Coming off the COVID communications-demand bubble when the work world shifted. But when this flow reversed and people started moving again, it was only natural there would be a surge in auto demand, as the market for laptops and chrome books drove off the cliff, ‘Thelma and Louise’ style. Of course, just like in the movies, where actors live past endings, semiconductor markets always live past dips – even Grand Canyon sized drops. This, along with other key data points triggered this month’s major revision. Data deviations from expectations took the forecast for 2023 into the dark side with a U-turn saddling the 2H22 and 1H23. This pulls the previous projection of a downturn from 2024 into 2023. Odds are the Fed may well achieve its goal of licking inflation with a soft landing. Far from Thelma and Louise, the experience of the silicon cycle teaches executives to be more like Evil Knievel: Fearless, yet prepared. Now, let’s consider our decadal future.

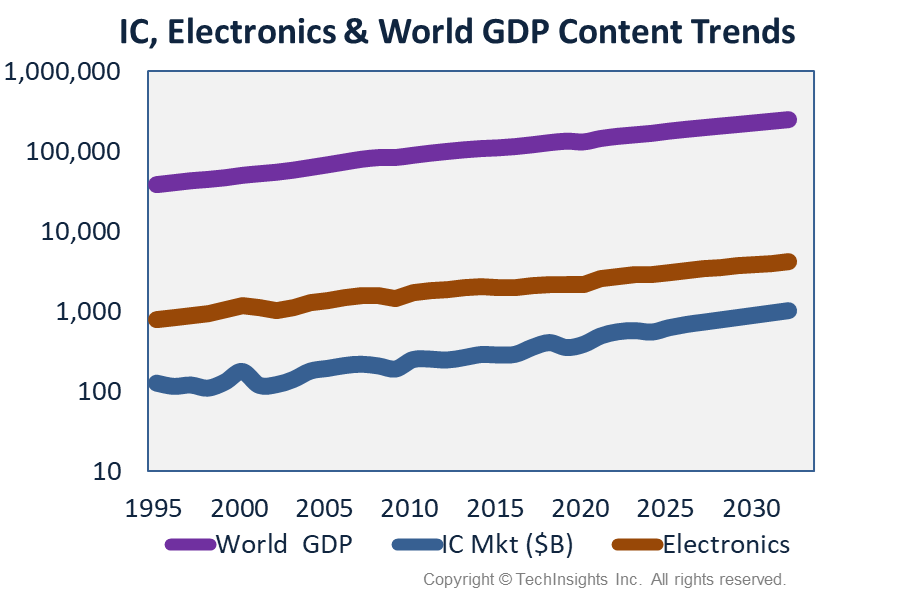

Long-Term Decadal Trends: Many have heard time and again the semiconductor market will be taken to $1T by 2030. ICs should reach that level by 2032. It is the long-term growth trend causing most experienced executives in the industry to dismiss the silicon cycle as mere bumps in the road to this horizon. They are, in my opinion, right to see the chip world this way. Moreover, as you can see the speed bumps have gone from the sleeping-policeman-sized bumps you see in parking lots to street-sized variations with little need to slow down. To a large degree, this explains the shift by semiconductor companies from tactical to strategic capital investing, resulting in a similar moderation of the demand cycle for semiconductor equipment. But that’s a different topic.

Of course, the $1T number for chips assumes the electronics market will stay on its trend to reach $4T by 2032. But is it sustainable? This question is critical, because one divided by four assumes a 25% semiconductor content rate. In the late seventies, an IBM economics paper that forecasted a peak of 15% postulated it could not sustain levels above 15% without challenging the electronics’ business model. Before you look at the next two charts, let me ask you to imagine if electronics is becoming a bigger or smaller part of the economy? It’s a parallel question to the content value of electronics in semiconductors. If you’re like me, the answer seems obvious: electronics must me a larger part of the economy today than it was decades ago. RIGHT? The results are not so obvious. By 2032, current trends will take the semiconductor equipment market to $0.3T. For all the silicon cycle Evil Knievel’s out there, there’s plenty more things to jump as we ride into the coolest industry’s decadal future.

“Forecasting is difficult, especially when it's about the future” – Yogi Berra

Click here to get more information about Semiconductor Chip Market Research Services

Free Newsletter

Get the latest analysis of new developments in semiconductor market and research analysis.

Subscribers can view more articles in the TechInsights Platform.

You must be a subscriber to access the Manufacturing Analysis reports & services.

If you are not a subscriber, you should be! Enter your email below to contact us about access.