Near-term order visibility remains low as semiconductor markets get past the bottom

Shereen Vaux

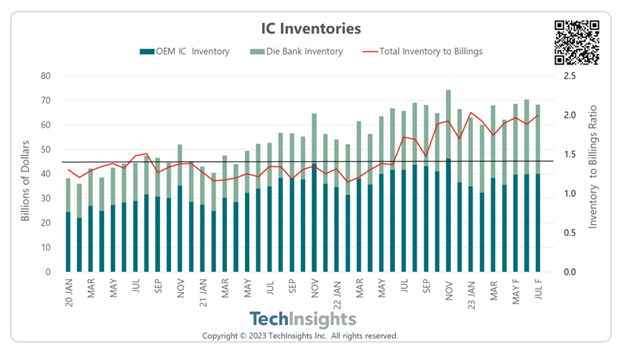

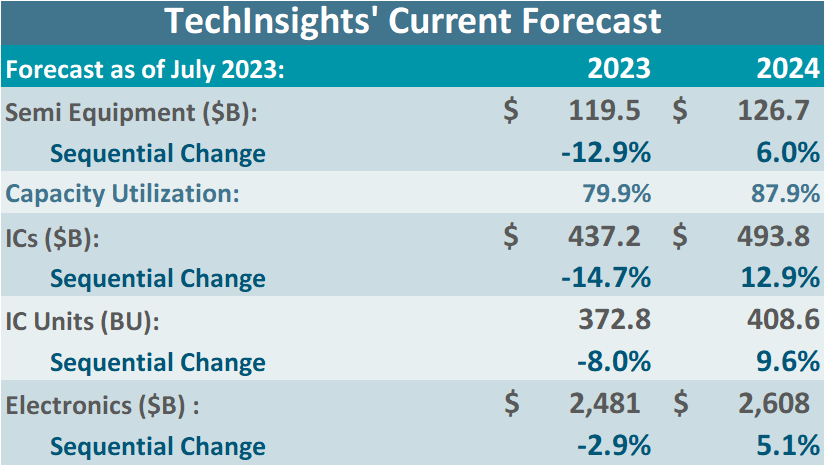

Order activity for semiconductor equipment increased but remains at a chilly 43 °F. As expected, TSMC is planning to double its CoWoS capacity next year as it remains a bottleneck for AI. In addition, demand from specialty markets remains robust, fueled by automotive and industrial segments. Demand from China has also been strong, as can be seen in ASML’s earnings. The sentiment at SemiconWEST was mixed. Most people were cautious about the strength of the recovery in 2024 due to looming macro headwinds and a potential recession. Semiconductor Equipment was upgraded for the year as trailing-edge demand remains strong, driven by China and the Automotive market. ICs were downgraded as Memory in Q2 is coming in lower than expected. The recovery is taking longer than anticipated because prices remain weak due to high inventories.

Free Newsletter

Get the latest analysis of new developments in semiconductor market and research analysis.

Subscribers can view the full article in the TechInsights Platform.

You must be a subscriber to access the Manufacturing Analysis reports & services.

If you are not a subscriber, you should be! Enter your email below to contact us about access.