It's hot but distant clouds threaten the upturn

Andrea Lati

- Order activity for semiconductor equipment continued to cool off, falling by half a point to a still-hot 111 degrees

- Q1 results for equipment companies have been in line with our expectations for a sequential decline in revenues in Q1

- Despite the ongoing supply chain challenges and macro headwinds the outlook for the equipment market remains bright

- Most of the growth will come in the second half of the year as the ongoing constrains subside

- Chipmakers have posted strong Q1 results

- Their sales are on track to increase sequentially in Q1, in line with our expectations

- Sustaining this strong momentum for the remainder of the year will be challenging for semiconductors especially if the economic deceleration becomes pervasive

- Die bank inventories increased much faster than expected in Q1

- TechInsights’ Chip Price Performance Index flashed a warning sign

- DRAM crashed

- NAND declined

- MPUs declined

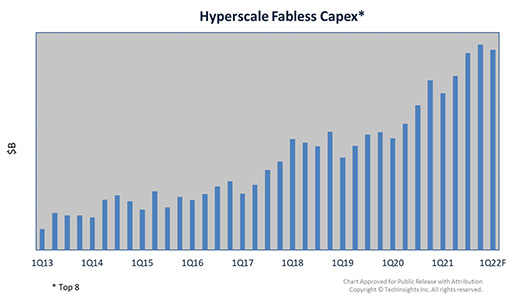

- Hyperscale Fabless Capex is tracking above seasonality in Q1

Free Newsletter

Get the latest analysis of new developments in semiconductor market and research analysis.

Subscribers can view the full article in the TechInsights Platform.

You must be a subscriber to access the Manufacturing Analysis reports & services.

If you are not a subscriber, you should be! Enter your email below to contact us about access.