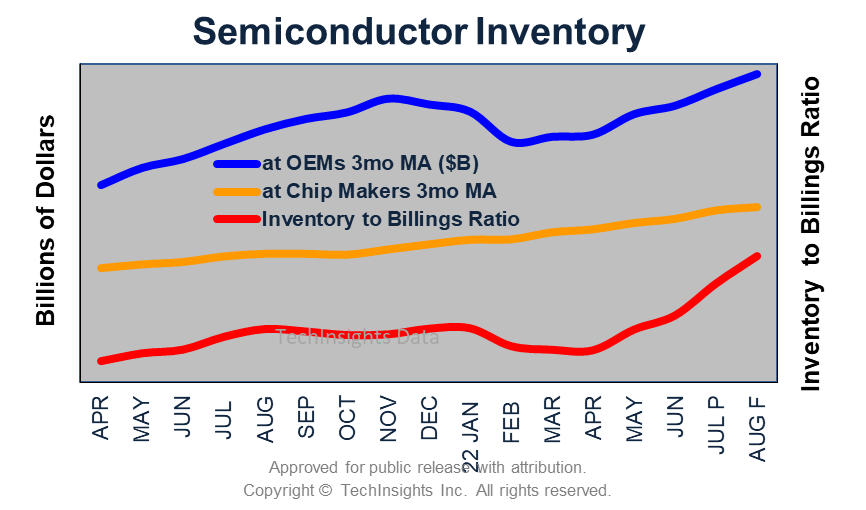

Inventories are turning red, casting a pall over the industry

Andrea Lati

- Order activity for semiconductor equipment extended its decline, slipping one point to 81 degrees in the second week of September

- Memory led the decline as order activity slipped to 69 degrees, which is in contraction territory

- The other largest segments, SOC Mobile and SOC Compute, held their ground at a warm 89 degrees keeping the overall order activity in positive territory

- The August data from the Taiwanese manufacturers were in line with our expectations

- It continued to show a bifurcating market environment—much like the order activity

- TSMC had a monster August with sales soaring to an all-time high

- While these record numbers are great for TSMC, they’re likely to fuel more excess inventories in the supply chain

- Subcons had a strong August with sales jumping 25% from a year ago, the same rate as the previous month

- On the Memory front, Nanya had an ugly month

- On the Fabless side, MediaTek sales continued to slow, increasing only 4% on yearly basis

- TechInsights’ Chip Price Performance Index pulled out of the dive

- DRAM fell

- NAND slipped

- MPUs declined

- Inventories continue to build up

Free Newsletter

Get the latest analysis of new developments in semiconductor market and research analysis.

Subscribers can view the full article in the TechInsights Platform.

You must be a subscriber to access the Manufacturing Analysis reports & services.

If you are not a subscriber, you should be! Enter your email below to contact us about access.