IC Supply/Demand Indices Loosened

February 2, 2022

Semiconductor sales continued to explode out of the normal Christmas lull, ending January near 2021's peaks. The IC weather cooled 2°F last week.

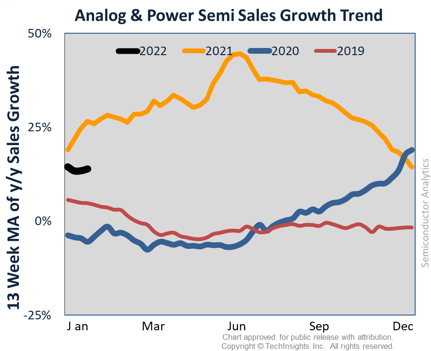

Semiconductor Sales growth continued to rise above the 20% Y/Y bar. This is well above last year's levels at this time.

TechInsights' IC Supply/Demand indices loosened last week, with More than Moore Foundry dropping back to Saturated and Moore More to Loose. OSAT also slipped out of Shortage conditions to Tight. Unchanged were DRAM and Auto at Shortage levels - NAND, IDM, and Analog & Power at Tight. With the Lunar New Year ahead, the loosening is still likely seasonal and not a sign of weak demand or over capacity.

Zooming in on Analog & Power this week, the 13-wk MA growth is hovering above 10% for the third week, breaking the fall from the 40-plus percent peaks in mid-2021. This is sustainable and close to TechInsights' 2022 Analog & Power forecast for sales to pass $100B and grow at 11%.

Electronics' Retail Prices continue to soar.