Ericsson and Nokia 5G Base Station volume and massive MIMO capabilities

Success in competitive Chinese market accelerates

Share This Post

1. Nokia and Ericsson significantly increase 5G market share in China

Even as several EU regulators are debating closing the European market to the largest Chinese 5G base station suppliers, European vendors are winning an increasing share of new base station awards in China.

After years of research and development and multiple small deployments Nokia and Ericsson are poised to capture a significantly greater share of China Mobile’s (CMCC’s) base stations. This is the result of years of commitment to 5G technology development to meet the requirements of the vast Chinese market. Both Ericsson and Nokia have invested to optimize their 5G technology for Chinese operators, and Ericsson has invested in Research and Development in China for many years. Recently Ericsson deployed power saving baseband processing units (BBUs) at more than 1,600 sites on China Mobile’s network in Jiangxi province to demonstrate over 30% energy savings from Ericsson’s earlier version. Earlier in 2022 Nokia showed that on CMCC’s network its AirScale 5G baseband platform could leverage carrier aggregation to combine 30 MHz in the 700MHz band with 160MHz in the 2.6GHz band for a total of 190Mhz that could deliver a peak downlink speed rate of nearly 3Gbps – that is now an industry standard.

Now both players are being rewarded with significant base station orders from China Mobile for 2023 and 2024 as CMCC seeks to get highly competitive bids from diverse Chinese and non-Chinese suppliers.

1.1 Scale and Advanced State of 5G in China

Scale of the Chinese Market: The magnitude of the Chinese market and the importance of achieving early economies of scale – especially in mid-band frequencies – cannot be underestimated. In April 2023 China’s Ministry of Industry and Information Technology (MIIT) announced that Chinese operators now serve over 620 million subscribers from “over 2.64 million base stations… (and) China plans to add around 600,000 (additional) 5G base stations this year (2023) to increase .to 2.9 million by the end of 2023.” At the end of June, 2023, MIIT announced that this goal had been achieved 6 months ahead of schedule and deployment continues.

An independent source sponsored by the European Commission- the 5G Observatory Biannual Report (April 2023) – reported that China had more than 3 times the number of 5G base stations in all of South. Korea, Japan, USA and EU combined. In addition, according to TechInsights Worldwide Cellular User Forecast 2022-2027 as of 2022 China had approximately 50% of the world’s 5G subscribers.

Advanced State of 5G in China: Ericsson’s June 2023 Mobility Report notes that China’s base stations include “mid-band Massive MIMO in 2.6 GHz and 3.5 GHz, FDD 700 MHz and 2.1 GHz for national coverage, and plenty of dedicated 5G indoor sites…. The upgrade to 5G Standalone (SA) (in China) took place (in 2020) just one year after the 5G commercial launch. Now, all 5G sites and the majority of 5G smartphones have SA capability. Currently, more than 95 percent of 5G traffic is carried by 5G SA technology. Based on SA, new network capabilities have been commercially available for over a year, including network slicing for service separation and differentiated offerings, Voice over New Radio (VoNR) … (and) RedCap from 3GPP Release 17.”

China’s large scale and advanced 5G SA and 5G NR deployments are approximately 2 to 3 years ahead of those in North American and European markets. As a result vendors that operate in China are able to achieve significant early volumesand gain experience with 5G systems, NR and service operations that they can leverage globally.

1.2 Recent China Mobile 5G award provides greater shares to European vendors

China began deploying 5G in 2019 and as of March 2023, 5G signals “covered all counties in the country”. Now that 5G coverage is established, Chinese Operators are moving to 5G densification.

China Mobile Communications (CMCC) is the bellwether for China’s mobile communications market. According to TechInsights’ Wireless Operator Performance Benchmarking (Q1 2023), CMCC has a 59% market share with more than 950 million subscribers, while rivals China Telecom and China Unicom who each have about 20% share. CMCC has the world’s largest mobile network and in 2023, capital expenditures for its 5G network are estimated to be approximately RMB83.0 billion ($11.6 billion USD, €1.4 billion). At the end of 2022, China Mobile had 1.3 million 5G base stations, 805,000 of which were mid-band, with plans to add another 360,000 base stations by the end of 2023. In short, CMCC is the most important buyer of base station equipment in the world. It is therefore highly significant that in its latest round of tenders for 5G base station equipment in the 2.6 GHz frequency range, China Mobile decided to award 16.33% of the order volume to Ericsson (Sweden) and 10.28% to Nokia (Finland).

Volumes were allocated as shown in the Exhibit below which is based on China Mobile’s Procurement and Winning Bidder announcements for the Package 1 2.6 GHz allocation. These represent significant volume wins for Ericsson and Nokia that should increase their global position and competitiveness as suppliers of mid-band base stations.

Exhibit China Mobile 2.6 GHz 2023-24 Base Station Awards By Vendor

| China Mobile Procurement Package | Frequency | No. New Base Station Sites | Vendor | Vendor Share |

|---|---|---|---|---|

| Package 1 | 2.6 GHz | 28,695 | Chinese Vendors | 73.39% |

| 6,385 | Ericsson | 16.33% | ||

| 4,019 | Nokia | 10.28% | ||

| Total | 39,099 | 100.00% |

Source: China Mobile Procurement and Winning Bidder announcements

Earlier in 2021 according to Counterpoint Research, Ericsson and Nokia had received much smaller shares of the three tenders issued by the new mobile operator China Broadnet and by China Mobile with 2% and 4% of the CMCC award respectively. Nonetheless, the awards represented a significant volume of new low-band base station deployments – 9,606 for Ericsson and 19,215 for Nokia.

Going forward both Ericsson and Nokia are likely to continue to receive ongoing base station orders from China Mobile and other Chinese operators for continued expansion of their earlier deployments.

2. Importance of massive MIMO in both China and other markets especially Europe

The recent 2023/24 mid-band awards described above represent significant early volume for Ericsson and Nokia, that should allow them to reduce costs as they accelerate their trajectory along the massive MIMO learning curve in advance of future mid-band deployments in the European market.

2.1 Ericsson and Nokia’s successful sales of massive MIMO to China Mobile enhance their global position

One of the foundational technologies for 5G is massive Multiple Input Multiple Output (mMIMO) – see TechInsights report “Massive MIMO is a Key Enabler for 5G Network Success”. mMIMO Antenna techniques can achieve impressive gains in speed, capacity and spectral efficiency compared to traditional 3-sectored antennas. However, the complexity of 5G massive MIMO demands significant new RF expertise and management. Experience in China should accelerate Ericsson and Nokia’s global competitiveness. Below we describe the advantages and the complexity that massive MIMO brings.

Massive MIMO brings Capacity, Coverage, Speed and Spectral Efficiency: Massive MIMO utilizes basic physics to exploit multipath propagation for signal gain rather than treating it as interference. MIMO in mobile networks typically uses 2, 4 or sometimes 8 antennas. Massive MIMO expands on multi-antenna techniques by using larger numbers i.e. 16, 32 or 64 antenna elements to focus the radio’s energy into narrow beams, like a spotlight. By directing a beam at a mobile device, the user can obtain higher speeds than they would otherwise. By moving the beam from one user to the next, system capacity and spectrum utilization is increased. Multi-User MIMO (MU-MIMO) takes this even further by using multiple beams to serve multiple users simultaneously. This further increases the capacity, coverage, speed and spectral efficiency of the cell.

Massive MIMO leverages arrays of smaller antennas for massive traffic volume at higher frequencies: The optimum size of an antenna element is one wavelength of the signal being transmitted: for example, 37 cm at 800 MHz but it is only 8.5 cm at 3.5 GHz. Low-band antennas are therefore significantly larger than mid-band. In mid-band and mmWave spectrum massive MIMO enables large arrays of smaller antenna elements. This is important because new 5G allocations in many countries – including China – are being designated in mid-band spectrum. These mid-band allocations generally offer much more MHz – typically up to 100 MHz and even 300-400 MHz globally. This means that where mid-band spectrum is deployed, it has the capacity to carry a large volume of traffic although more base stations are required for coverage at these higher frequencies.

Massive MIMO brings real time processing for radio channels and Algorithms at the Edge: In addition to antenna arrays equipped with the essential analog microwave electronics, massive MIMO requires considerable real-time computation to adapt to rapidly changing channel conditions. Extensive expertise is required to develop the Algorithms that determine: the precise current state of the radio channel – ‘channel estimation’ – as well as the speed and optimal ways to represent the data as signals on the radio channel – ‘adaptive modulation and coding’ – and knowledge of how to point the beam(s) and to tune the antenna elements for best performance – ‘beam steering’, all in near real time.

These very complex algorithms often take years to develop by teams of Ph.D.-level engineers, They are validated with proprietary simulations and lab and field testing; and in addition must be fine-tuned in the real world, by trial-and-error, for optimum performance.

These algorithms directly affect operators’ Capex and Opex, efficient use of valuable spectrum resources, and their energy usage and even their mobile users’ experience. Thus, massive MIMO algorithms are becoming critical competitive differentiators and represent a key part of each vendor’s most valuable intellectual property.

Learning Curve: The cost of products at market introduction generally declines as more and more units are produced. This economic principle is called the ‘learning curve’ or the ‘experience curve’. Both vendor profit margins and pricing follow the learning curve. In fact, vendors often sell their early production at a loss in order to move along the curve faster and reap profits as they achieve high-volume production. Nokia and Ericsson have already benefited from their share of China’s early mid-band rollout and have moved down the initial learning curve. The cost of their massive MIMO RAN equipment is likely to have been significantly reduced as a result. Operators who began their 5G mid-band procurements later – especially European operators – should therefore benefit both from their vendors increased expertise and from volume driven lower costs.

Early deployments in China afford the two Nordic vendors both highly valuable real-world experience, and sales volumes that lower their costs. These are expected to translate to benefits for both operators and their end users as well as success for the vendors in European and North American markets.

2.2 Chinese Operators are much further along in their massive MIMO deployments

Public data are not readily available for numbers of massive MIMO sites deployed by operators in China and Europe. However, most mid-band radio units use massive MIMO, so we have examined the numbers of mid-band sites as a reasonable proxy for massive MIMO sites.

5G deployment in China by CMCC and the other Chinese operators is much further along than European deployment overall. This is particularly the case for mid-band spectrum – See European Commission sponsored ‘5G Observatory Biannual Report – April 2023’ where 2.6, 3.6 and 4.9 GHz have been assigned in China and 3.6 GHz in Europe.

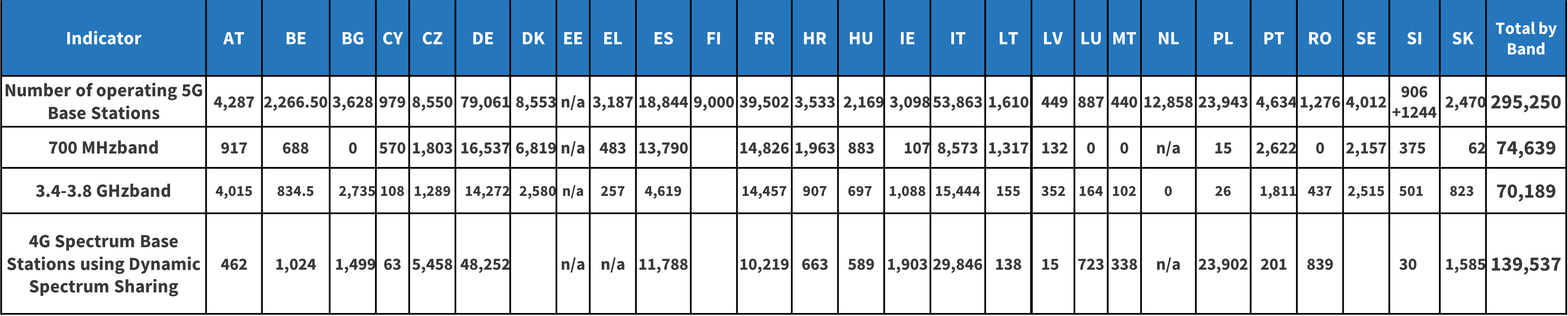

According to that report, as of March 2023, there were just over 70,000 mid-band base stations in Europe (exclusive of Finland).

Exhibit 2 Numbers of Base Stations per European Country by Band and Total as March 2023

By contrast, at the end of 2022, out of a total of 1.3 million base stations China Mobile alone had 805,000 mid-band base stations – over 11 times the number in all of Europe as of March 2023. While publicly available data are not available, we believe that the other Chinese operators have made similar progress in their mid-band deployments.

3. Experience in China with massive MIMO enhances position of Ericsson and Nokia as global competitors

European vendors that are able to deploy large numbers of mid-band sites in China in 2023 and 2024 are likely to reap not only significant revenues, but also capture production cost benefits, in the form of deployment experience and rapid progression along the volume learning curve as a result of access to China’s vast and competitive market for 5G mid-band base stations.

In July 2023 in its Second Quarter 2023 Press Release -Ericsson announced that “75% of all base station sites outside China are not yet updated with 5G mid-band” and in its Report for Q2 and Half Year 2023 News Release Nokia similarly noted that “only approximately 25% of the potential mid-band 5G base stations (are) so far deployed outside China.”.

Both vendors are eagerly eying the opportunity to take their expertise in mid band and massive MIMO global.

To see the full Report go to: Success in competitive Chinese market accelerates Ericsson and Nokia 5G Base Station volume and massive MIMO capabilities